Manage a returned super payment (AU)

Sometimes you may have your employees super returned for various reasons but you have already processed this through MYOB Acumatica and are not sure how to correctly have this sent through again. Please follow the below instructions for how to manage these situations in MYOB Acumatica.

-

Identify why the super has been returned to the employee and first fix those problems - For example this might be that their member number is incorrect or perhaps the incorrect super fund was selected for the employee.

See the online help for instructions on adding a super annuation fund or setting an employee's fund.

-

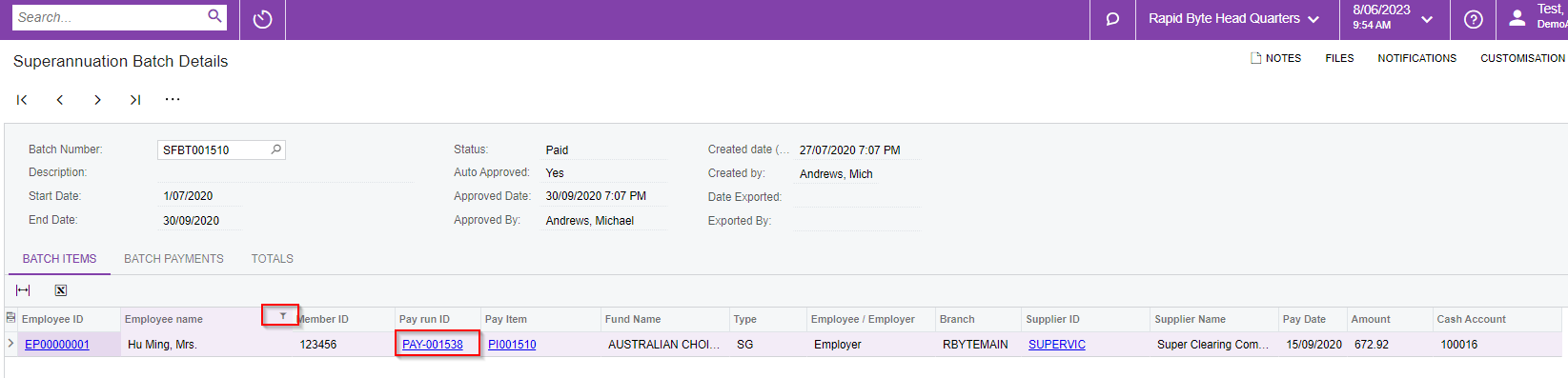

Once the changes have been made for the employee you will now need to find out what pay runs were included in the batch and returned. To do this you need to open the Superannuation Batch Summary screen and drill into the Super batch that was returned.

-

With the open batch use the filter to filter by the employee that had their super returned - take note of all the Pay run ID’s listed

-

Now go to Manage Pays And in the drop-down select “All” From here you need to open the pay/s that were listed on the superannuation batch and adjust the pay for the specific employee that had their super returned. Learn how to adjust pays.

Do not make any changes to the employee’s pay you do not want to change any of the figures the monetary value will remain the same this is just to update the superannuation details you modified in step 1

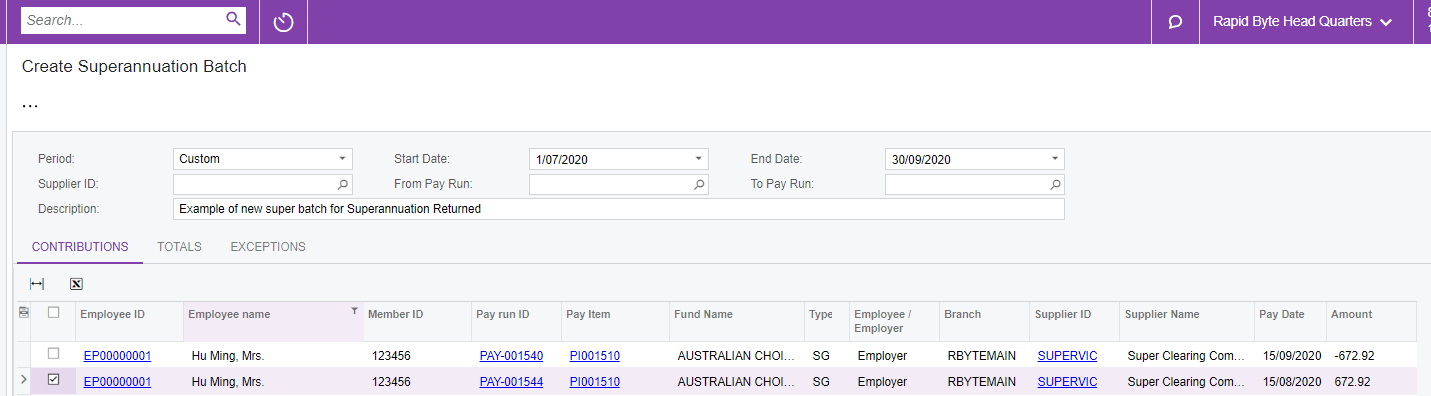

5. Once this has been processed you will need to create a new superannuation batch for the same period that was returned.

6. In the Batch items you will see a positive and a negative figure appearing for the Employee with the New pay run ID that you have just processed please choose only the positive figure

7. You may now continue to process super as per normal

There is no way to remove the negative figures from the system so they can just be ignored.