Changing the structure of your financial year

Build 2021.117.400.6951 [21.117.0037] onward.

The Australian financial calendar starts on the 1st of July and finishes on the 30th of June the next year, and so naturally this is also the structure of the financial year in MYOB Acumatica for Australian companies (similarly, for New Zealand, the financial year starts on the 1st of April and finishes on the 31st of March). In some circumstances, the customer requires the structure of the financial year to be changed. For example, the company got acquired by a European or a US company, and therefore the customer would like to have the structure of the financial year changed to January to December to match the parent company for ease of reporting. This article is about the options for changing your financial year structure and the related limitations.

Changes to financial year structure are high risk and time consuming. Before making them to your live company, thoroughly test them in a test environment and make sure the company's accountant has approved the change.

In the current design, the system holds the running net values of profit and loss in the YTD net income account. When you process a year-end procedure, the values in the YTD net income move to the retained earnings account. So, if you change financial year and process the year end then whatever value which is placed in YTD net income will move to retained earnings account.

The above procedure does not give any accounting or tax advice, and it must be discussed by the company accountant on how their yearend process will play a role with their Income tax returns.

The below steps are NOT applicable if the company:

- The company has implemented the Fixed Asset module

- The company is using the Deferred Revenue and Deferred Expenses

- The company has financial documents posted for the future periods.

If the company falls into any of the above categories, please log a support ticket.

Case studyIn this example, the company Rapid Bytes is using the Australian financial calendar with 12 financial periods, from 1st of July to 30th of June. The current financial year is 2022. They are changing their financial calendar structure to 1st of January to 31st of December for financial year 2023.

- Firstly, we need to ensure that the current financial year (2022) is the last financial year in the Master Financial Calendar screen (GL201000). If there are subsequent financial years, we need to delete those financial years.

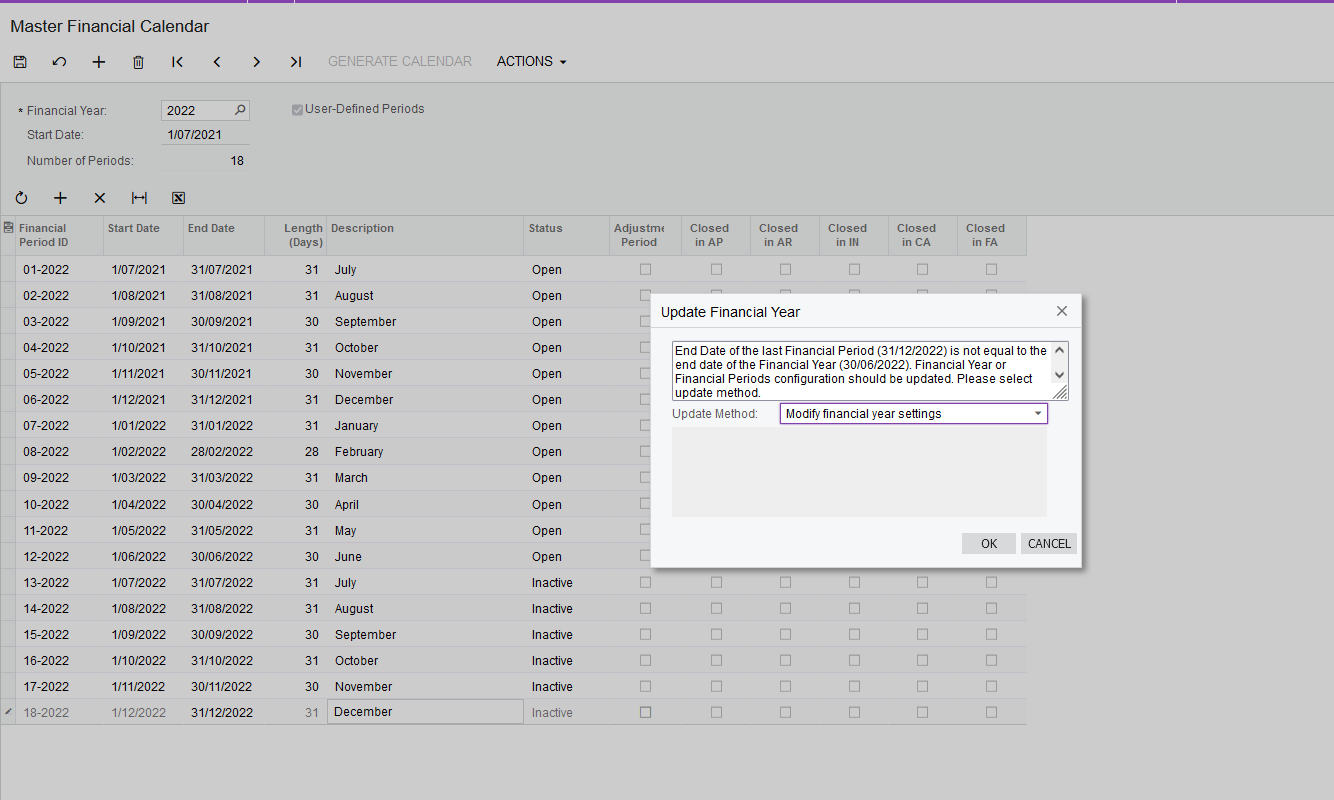

- Select financial year 2022 and tick the box “User-defined periods”. Click YES when the system displays a warning prompt:

- Start adding financial periods with the end date being the end date of next month (July):

- Continue until you finish adding financial periods up until December. Press Save when finish. Upon pressing Save, the system will display a warning pop up. Click OK to update the structure of the financial year.

- Starting the next financial year (2023), the period will start on the first of January

As always, please perform these configurations in a Test environment, verify that all the screens, reports and areas that might be affected by the change are working correctly before implementing in the production environment.