Creating a tax GL journal

This page is for MYOB Acumatica consultants

Check all changes in a test environment before taking them live. Make sure all related features still work as expected and that your data is unaffected.

This knowledge base article shows you how to create a GL journal (journal transaction) that contains a tax transaction, that will also appear in the tax report.

These instructions are for MYOB Acumatica builds 2021.117.400.6951 [21.117.0037] onward.

-

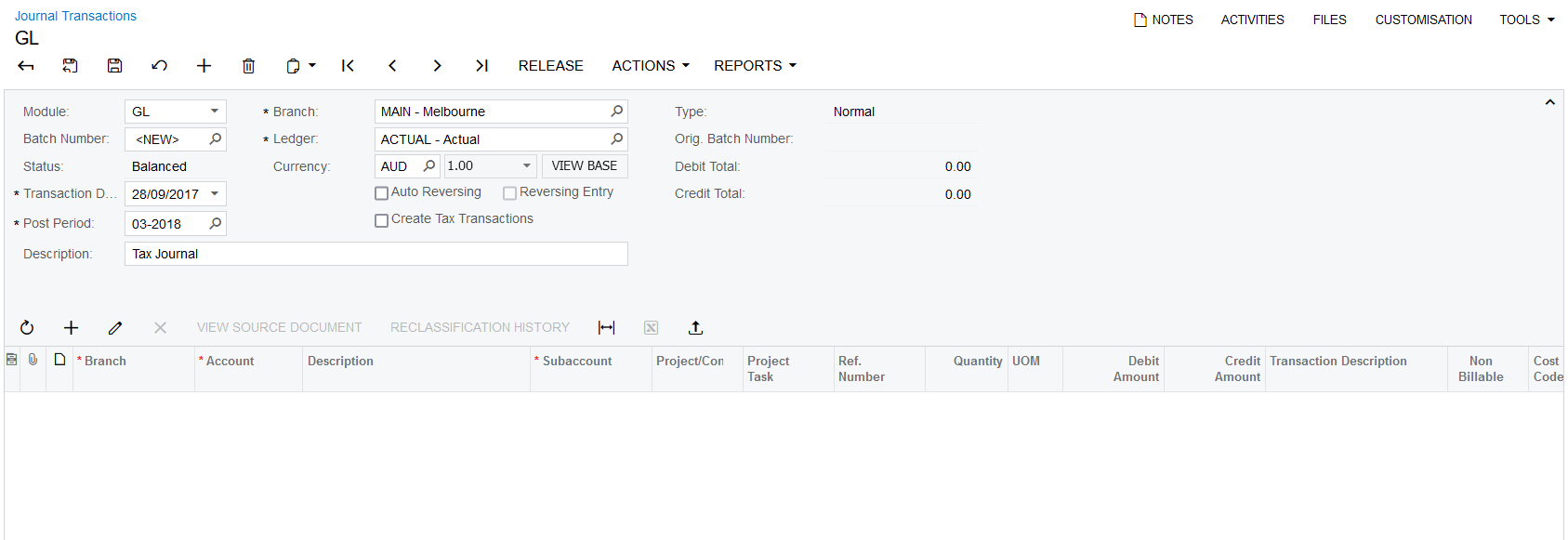

Go to the Journal Transactions screen (GL301000).

-

Create a new Journal Transaction. Module = GL.

-

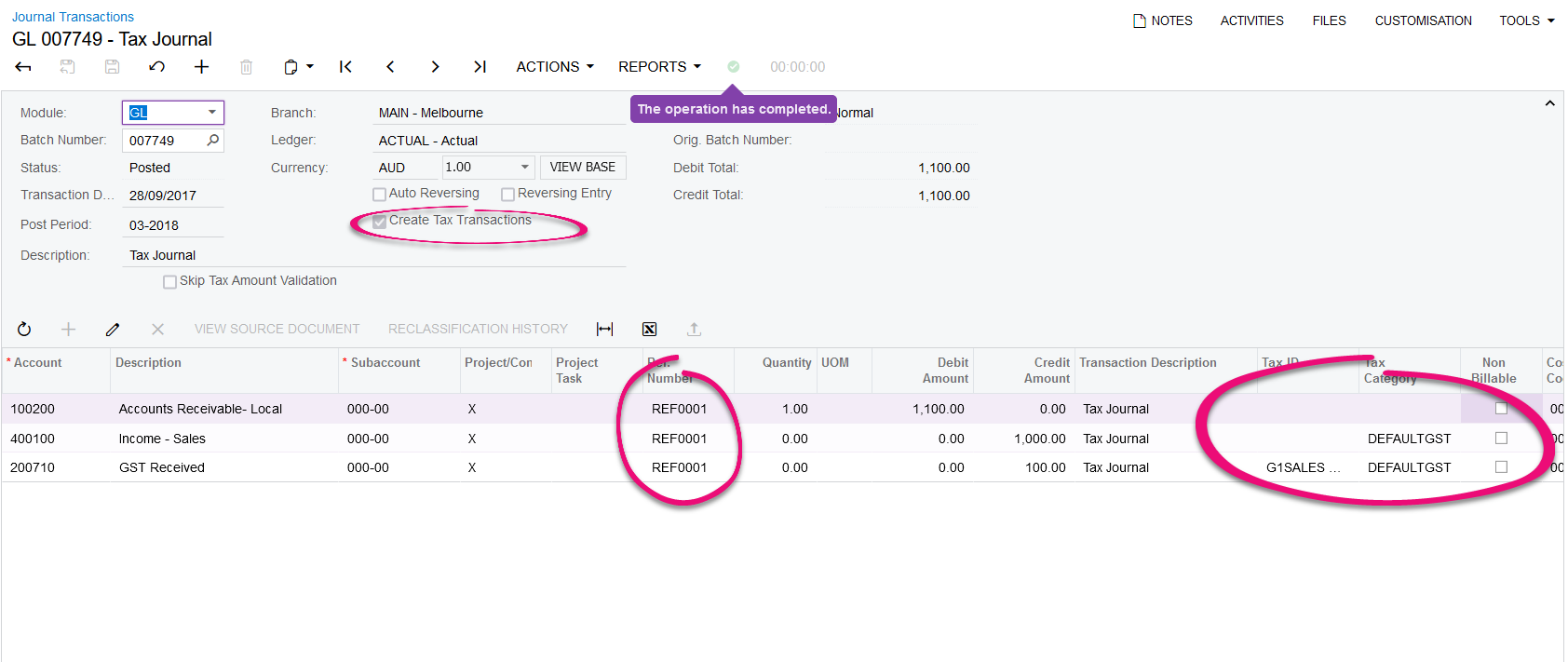

Enter the journal transaction as normal, ensuring total debit and total credit are equal. However, there are some additional requirements for the tax amount and the GL Journal to go to the tax report:

-

There must be an Asset or Income account / Liability or expense account used for the journal.

-

Ref number is a must which will ensure that values reach BAS.

-

Enter the journal like below but you will have to calculate the tax amount manually.

-

Select the Create Tax Transactions checkbox.

-

The Tax IDs can only be chosen for GST paid, and GST Received account assigned to the relevant GL account

-

Ensure that TAX ID and TAX Category is assigned to the Tax amount line and Tax category is assigned to taxable amount account line.

-

-

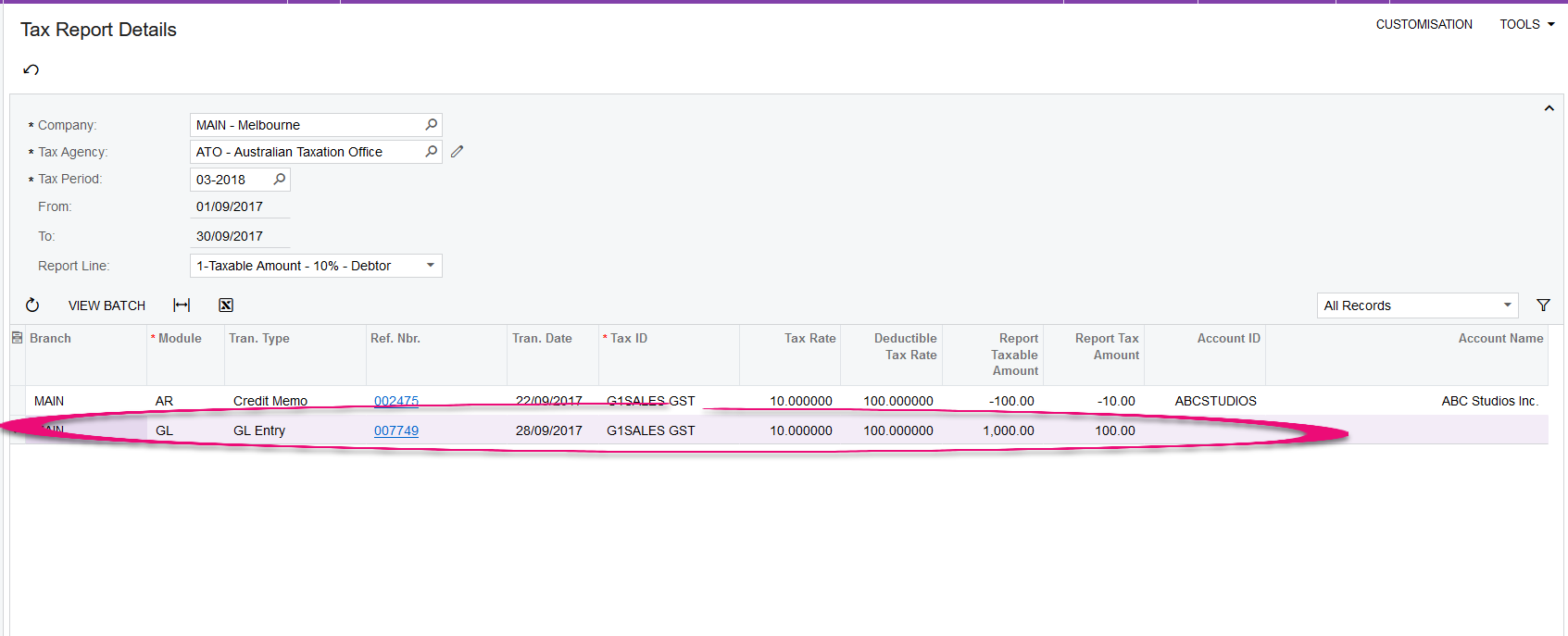

If everything is correct, you will see the GL entry appear in the Tax Report.