Excise reporting and maintenance for breweries

This page is for MYOB Acumatica consultants

Check all changes in a test environment before taking them live. Make sure all related features still work as expected and that your data is unaffected.

This knowledge base article was accepted as a solution to allow an Australian brewery to report the excise payable on the sales made. This knowledge base article consists of a custom solution and a generic inquiry plus commentary on the setup.

It is assumed that the reader is aware on how to import the custom solution package and the generic inquiry.

This solution only works when you are shipping the items through an order type that requires using the shipment process.

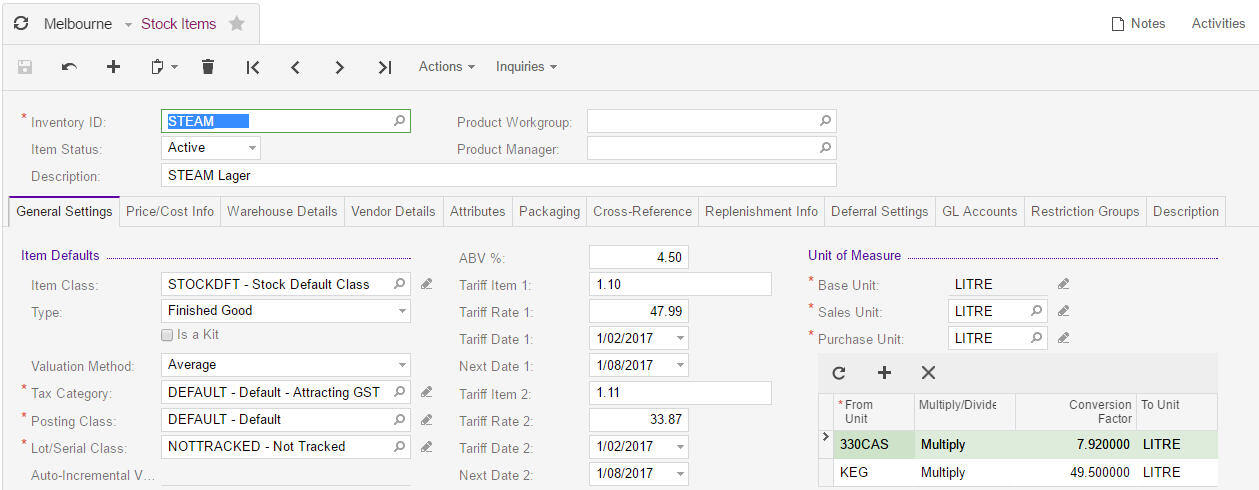

Item master data customisationBelow a third column has been added to the item master to record the Tariff and Rate that the beer will be taxed at. Tariff 2 is for the Keg UOM whereas Tarrif 1 is for lesser volumes.

The Base unit is litre to simplify the reporting required.

Reporting Excise Payable

Reporting Excise Payable

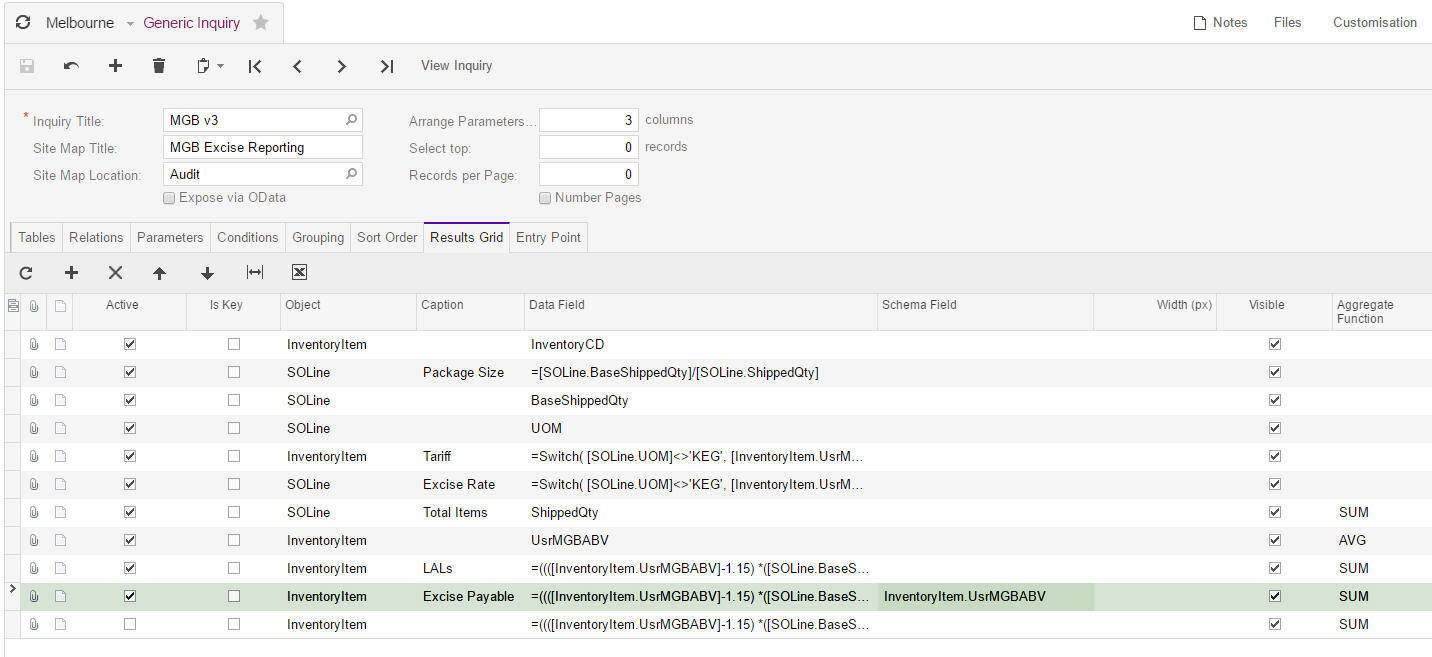

The generic inquiry attached is built up as follows where by switch function have been used to pick Tariff 1 or 2 based on the UOM used, this would need to be reviewed during the implementation phase.

Running the report will display as:

Updating Inventory with new tariff rates

Updating Inventory with new tariff rates

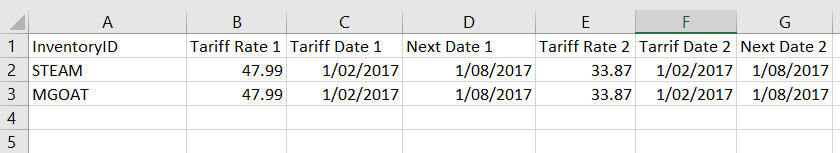

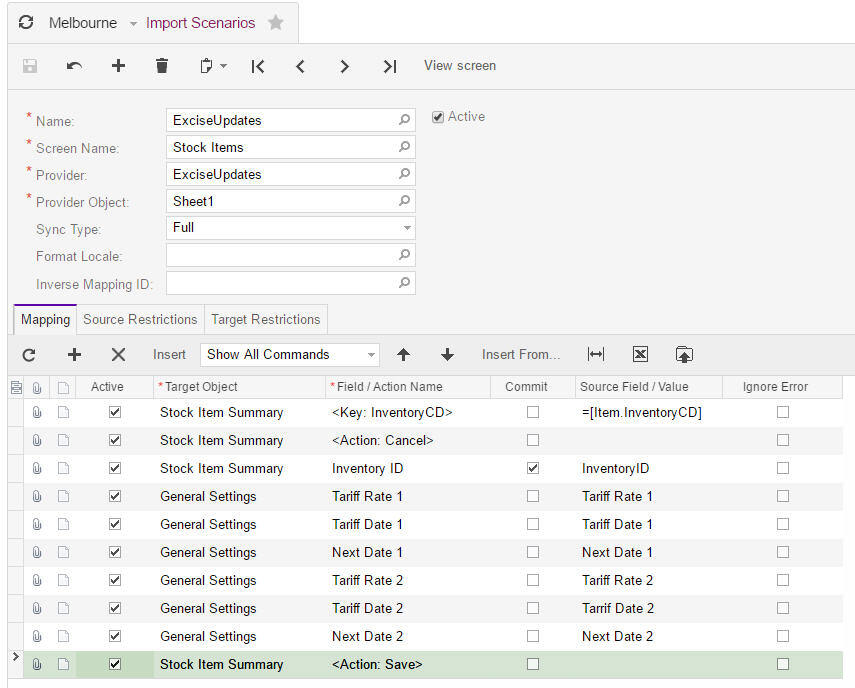

When the government makes changes to the rates the following data provider and import scenario can be used to maintain those rates.

File attachments

File attachments