Generating a GST credit memo

This page explains how to set up and generate GST Credit Memo for AR Invoices whereby you want to reduce the taxable amount when the invoice is paid early and a prompt payment has been applied.

Setup

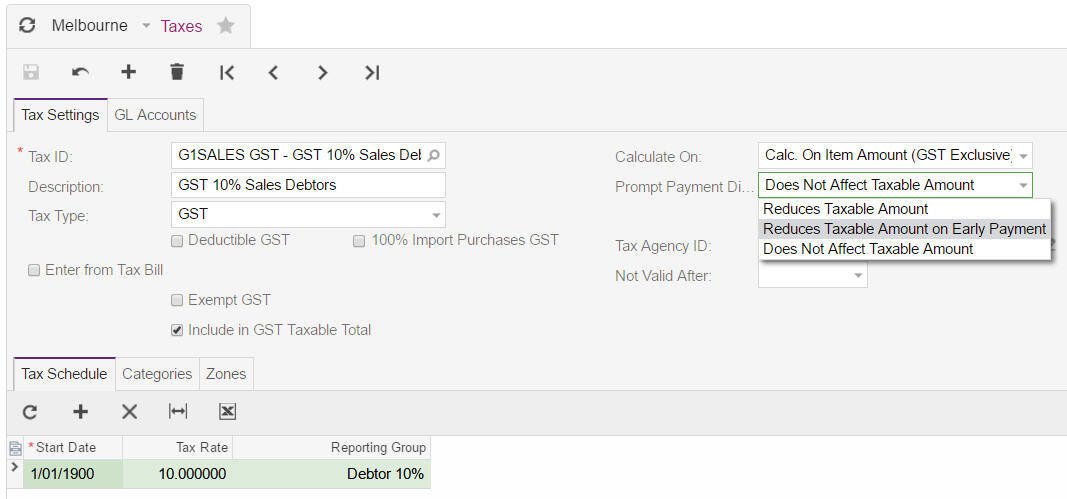

The following adjustment needs to be made to all the tax id's that will be used in the sales process, the field Prompt Payment Discount needs to be set to "Reduces Taxable Amount on Early Payment"

This knowledge base article assumes that you have correctly setup your tax zones, categories and linked the customer to an appropriate credit terms set to allow Prompt Payment.

Transacting

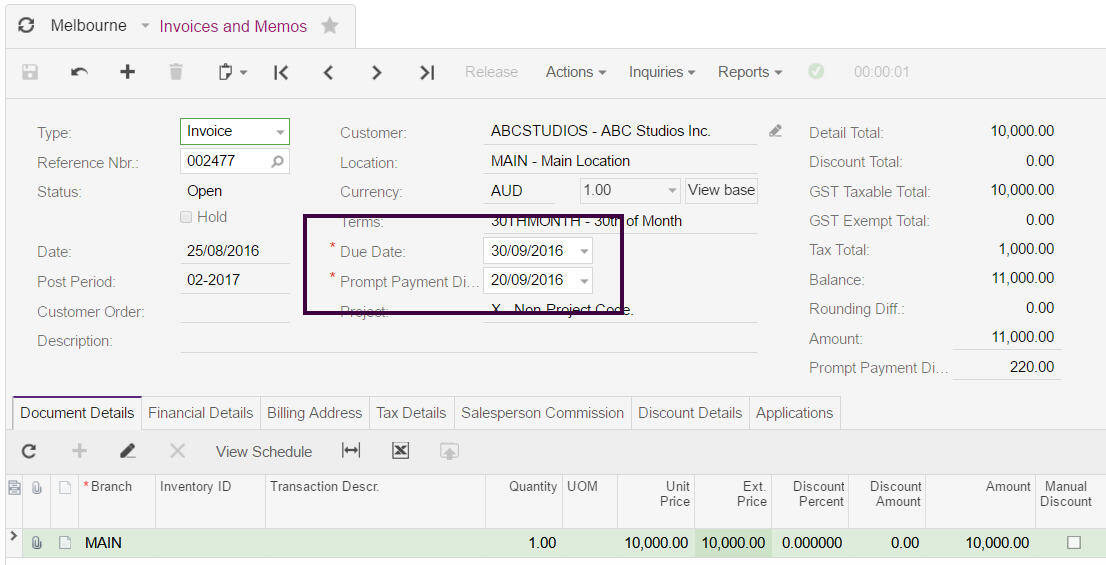

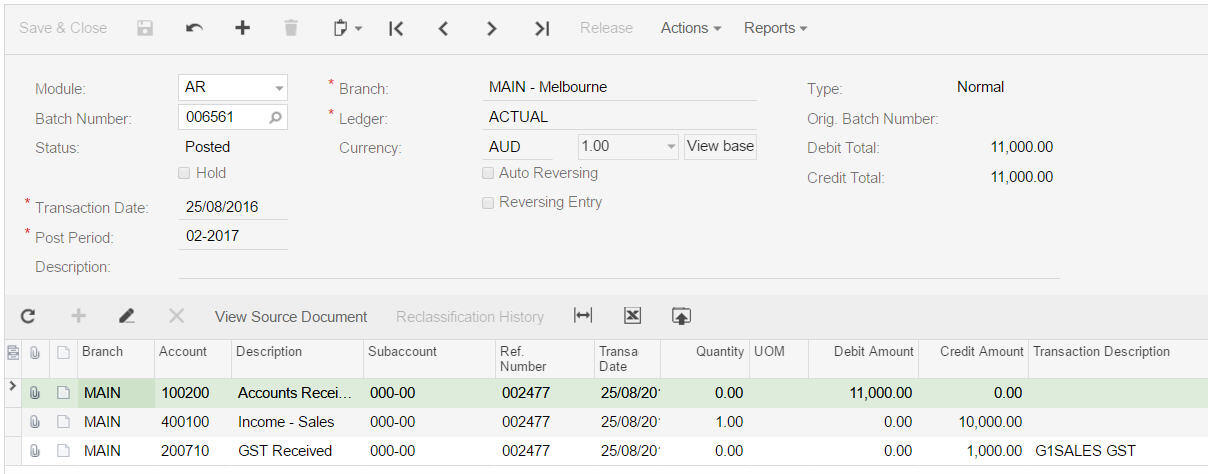

Before a GST Credit Memo can be generated a sales invoice with a prompt payment due need to be entered and released. Below is an example including the GL journal transaction.

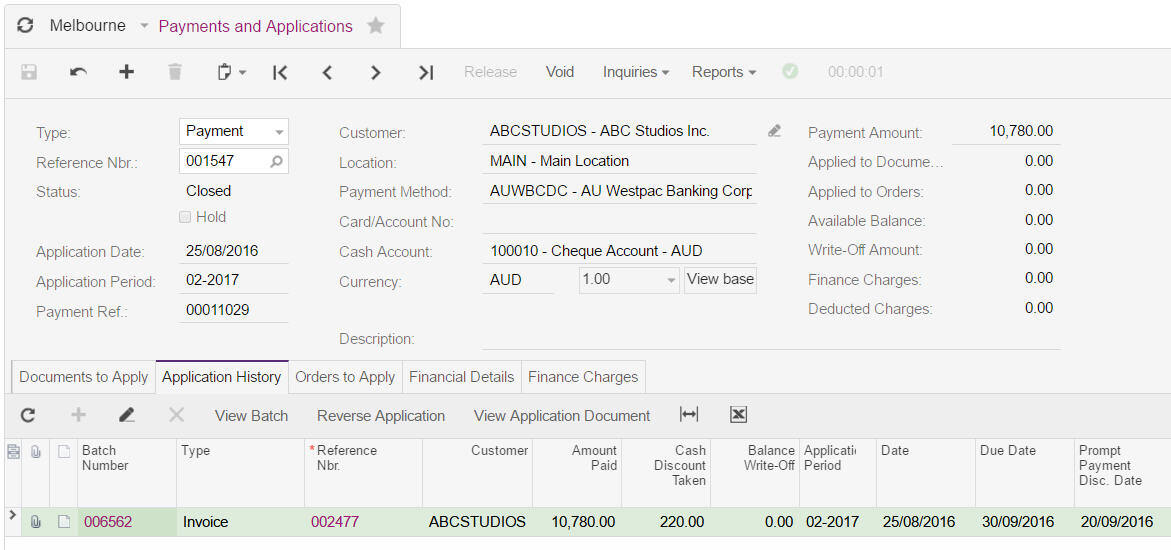

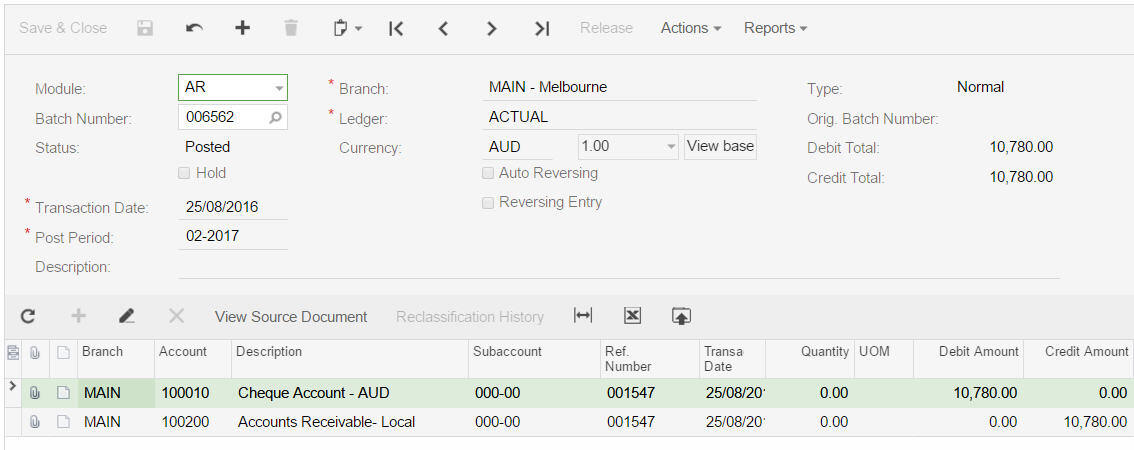

Once this invoice has been release, a payment needs to be recorded for the invoice which takes the prompt payment discount. Below is an example including the GL journal transaction.

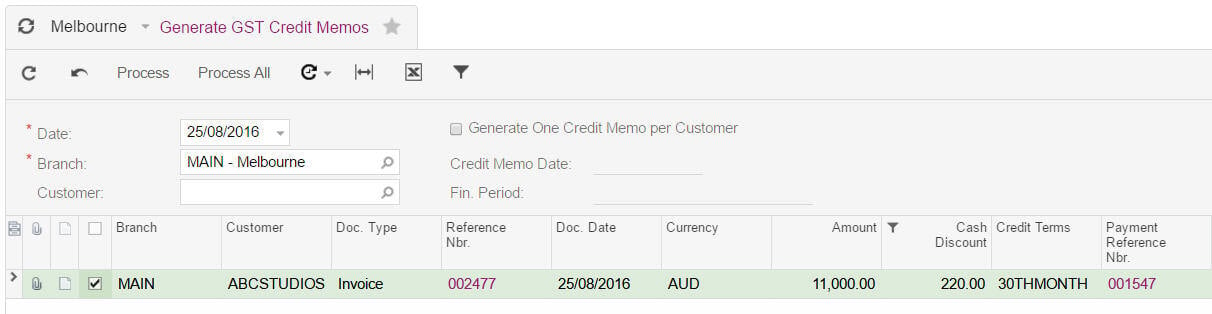

Once the invoice is paid and closed, the credit GST memo can be generated within menu path [Finance \ AR \ Processing \ Recurring \ Generate GST Credit Memos] - this screen will list all sales invoices that are linked to a Tax ID which has the prompt payment discount set to "Reduces Taxable Amount on Early Payment" and a prompt payment has been taken.

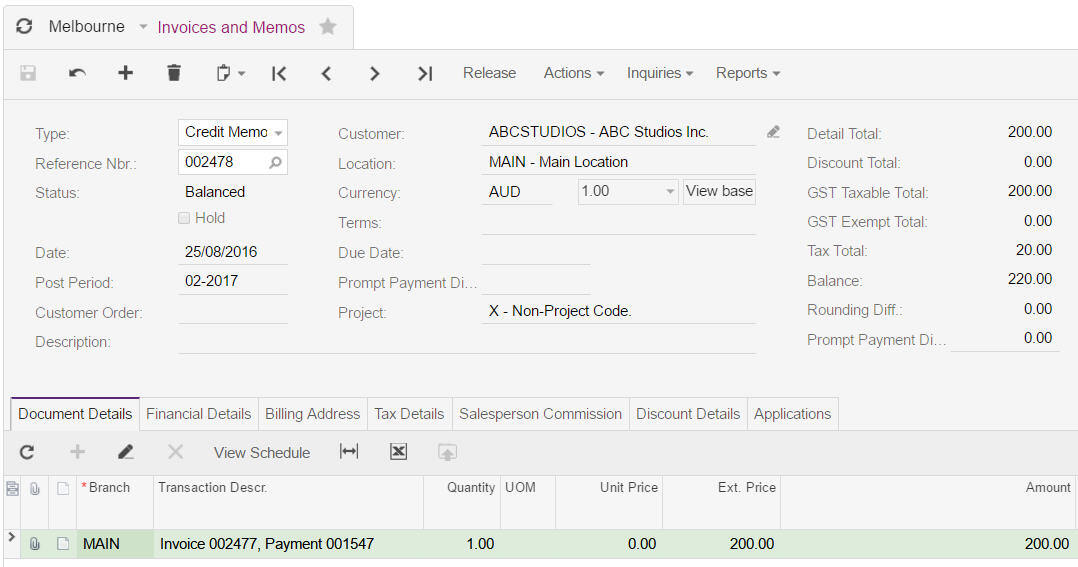

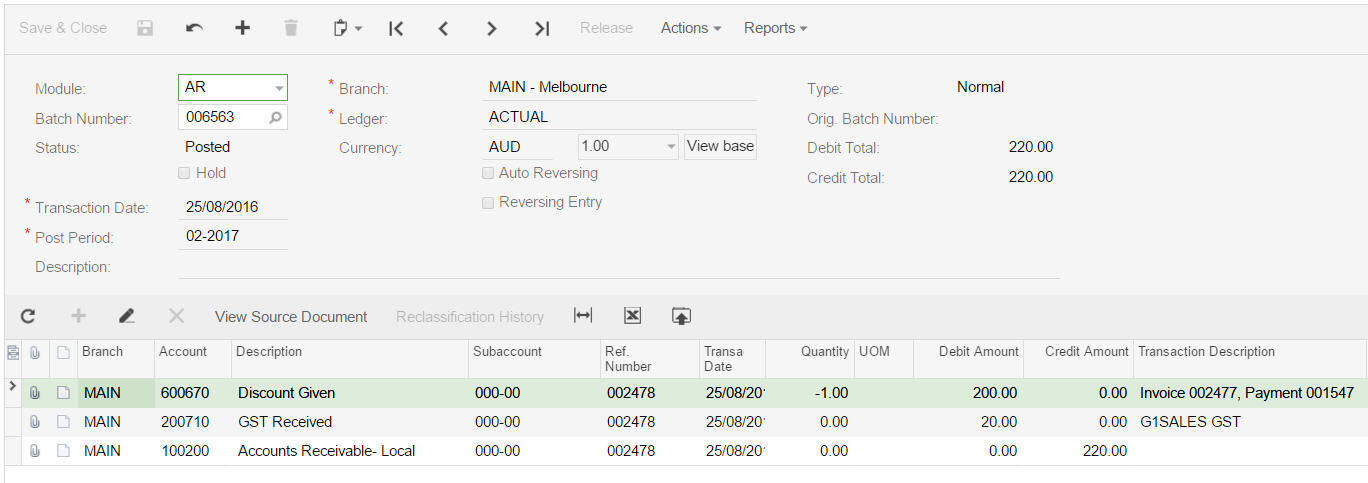

To generate a credit memo select the invoices and press Process. Below is an example including the GL journal transaction.