Handle Expense Claim for items with different GST calculations and expense accounts

It is very common that employees when submitting an Expense Claim, would need to include both GST-inclusive Expense Receipt items and GST-exclusive Expense Receipt items. You might also want to use different GL Account/Subaccount for each Expense Receipt item. This knowledge base article will show you how to handle this situation.

Build 2021.117.400.6951 [21.117.0037] onward.

Before you start, make sure that:

Employee has an Expense Claim that contains 2 Expense Receipt items:

Expense Receipt A – EXACCLEAN - Air Conditioner Unit Clean Up – GST inclusive

Expense Receipt B – TRAVEL- Travel Expense – GST exclusive

Enter this Expense Claim to MYOB Acumatica

To set it up:

Firstly, we need to create an Expense Receipt for each item that the employee is claiming. Go to the Expense Receipts screen (EP301020), create a new Expense Receipt. Select Expense Item = TRAVEL, enter Description = Travel Expense and specify a unit cost of $500. Select Tax Zone = DOMESTIC and Tax Category = DEFAULTLTD. Because expense item is entered as GST Exclusive, in the Tax Calculation, set to Net. You will see that the Claim amount is $550, in which $50 is Tax. If required, update the GL Account or Subaccount for this expense item.

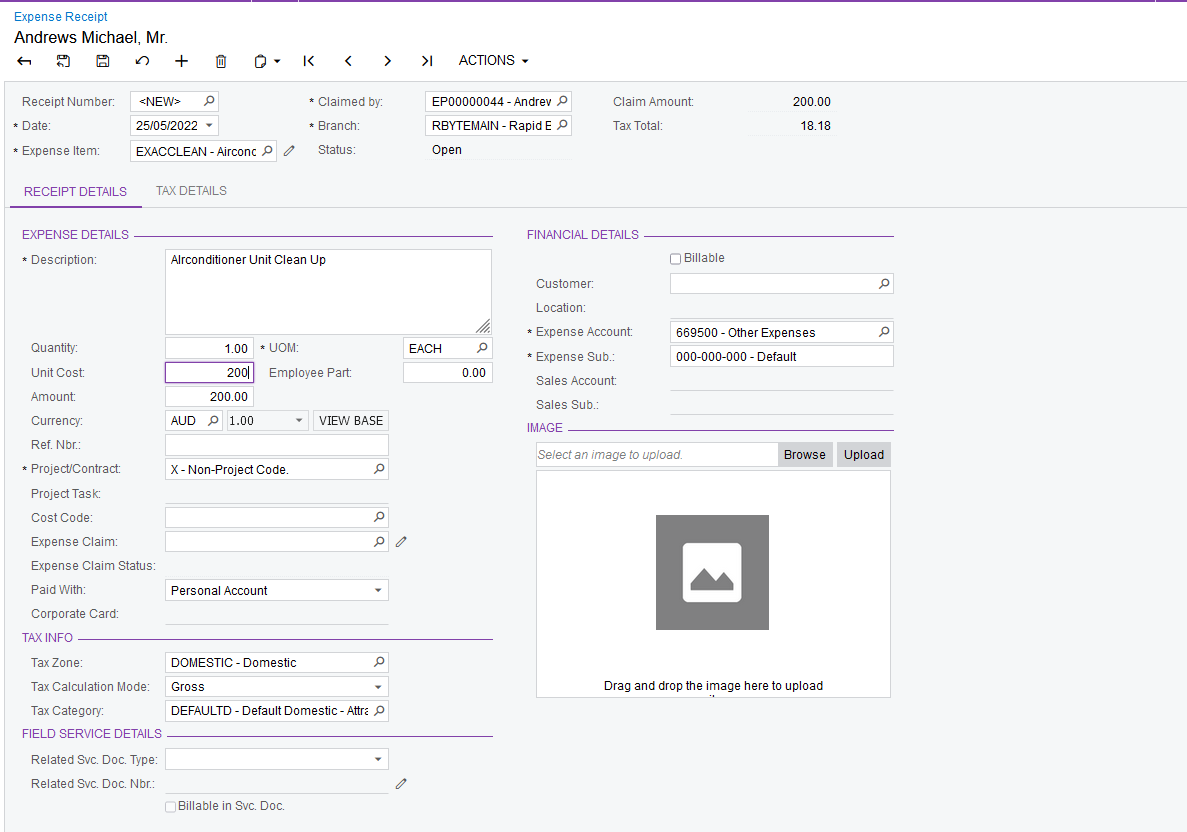

Create a second Expense Receipt for expense item EXACCLEAN – Air Conditioner Unit Clean Up. Specify Unit Cost = $200. Select Tax Zone = DOMESTIC and Tax Category = DEFAULTD. Set Tax Calculation = Gross. You will see that this time, the Claim Amount is $200, inclusive of the $18.18 Tax.

Now there are two ways to create an Expense Claim:

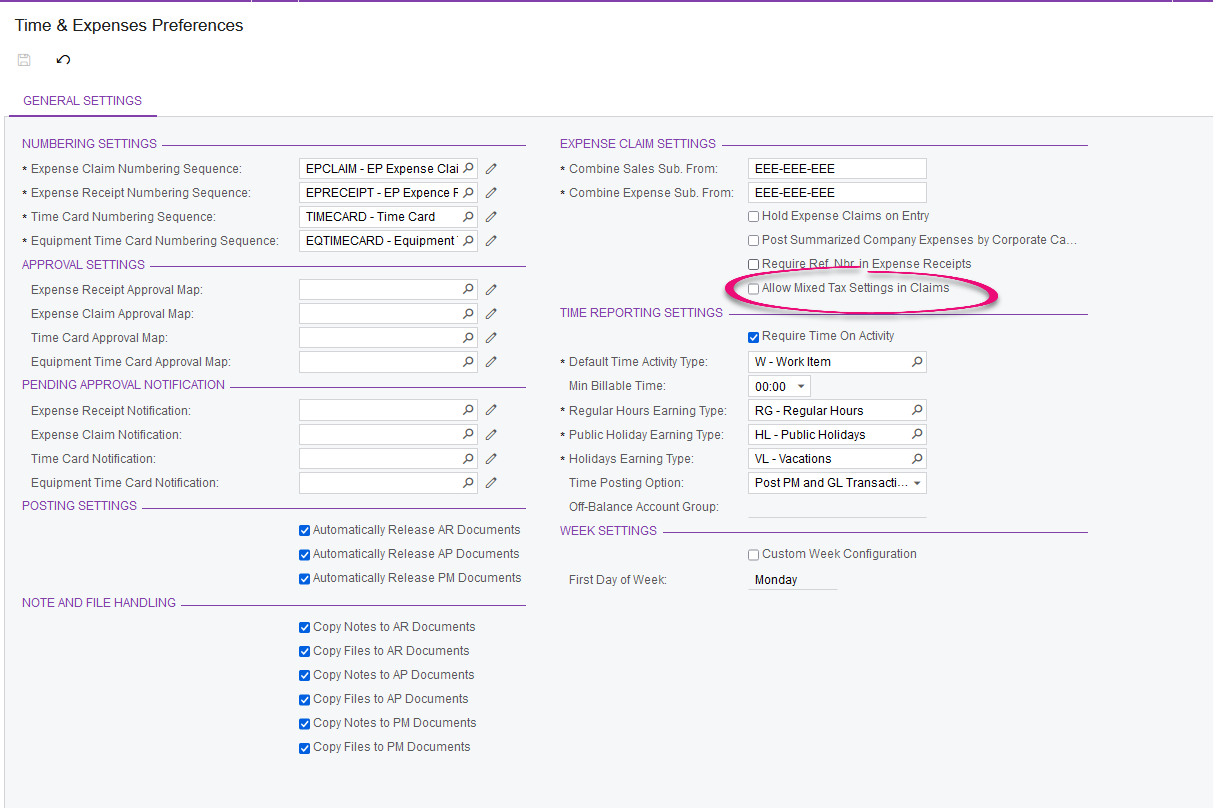

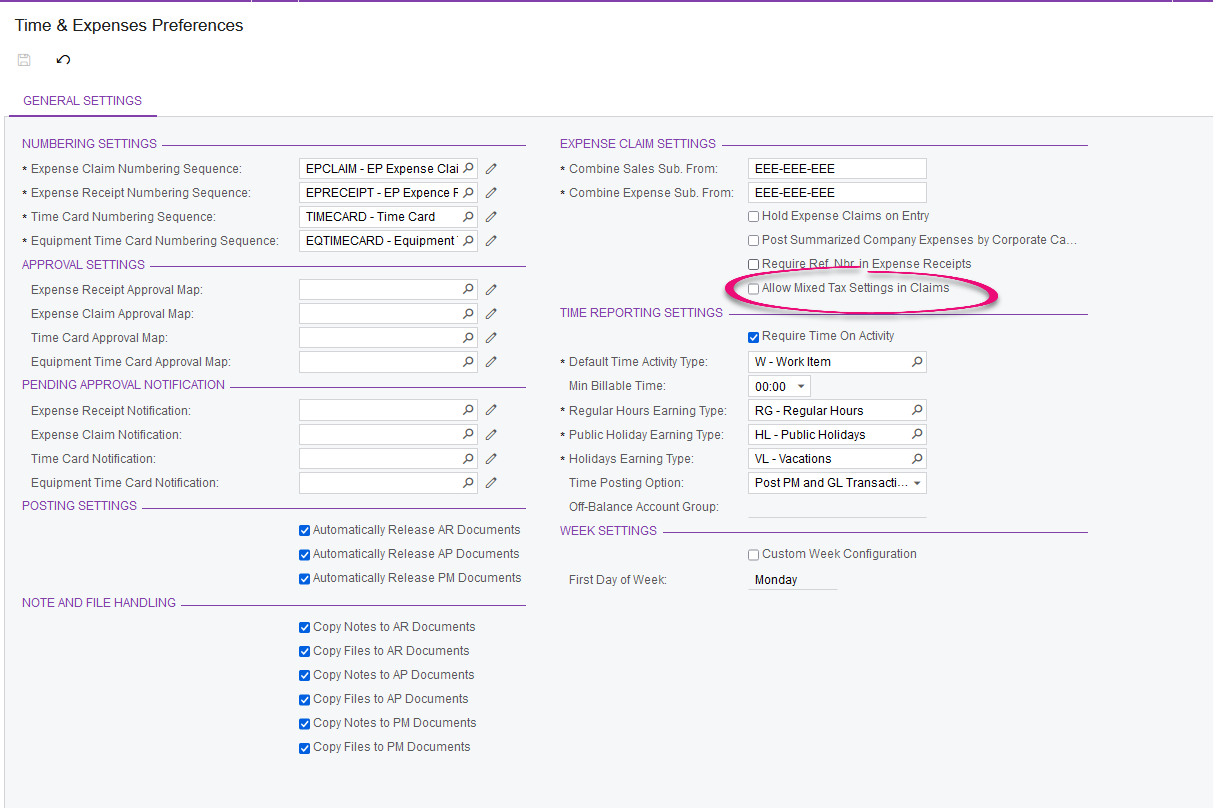

If you don’t want to group Expense Receipts with different Tax Zone and Tax Calculation Mode together, then untick “Allow Mixed Tax Settings in Claims” in the Time & Expenses Preferences. Then you will need to create one Expense Claim for each combination of Tax Zone and Calculation Mode. For each expense claim, the system will generate one AP bill.

If you allow grouping of Expense Receipts with different Tax Zone and Tax Calculation Mode together on an Expense Claim, then tick “Allow Mixed Tax Settings in Claims” in the Time & Expenses Preferences. When you create an Expense Claim, you can add Expense Receipts items with different combinations of Tax Zone and Tax Calculation Mode together. The system will group expense receipts with the same Tax Zone and Tax Calculation Mode together and generate one AP Bill for each combination.