Handle payment rounding for cash sales

If you’re a business that normally deals with a lot of cash sales, or cash payment method in general, very often you will encounter rounding issues where the invoice amount is slightly higher than the payment amount received, due to the payment being rounded down. This knowledge base article will show you how to handle payment rounding in such situation.

Build 2021.117.400.6951 [21.117.0037] onward.

Create an invoice with the balance of $50.96:

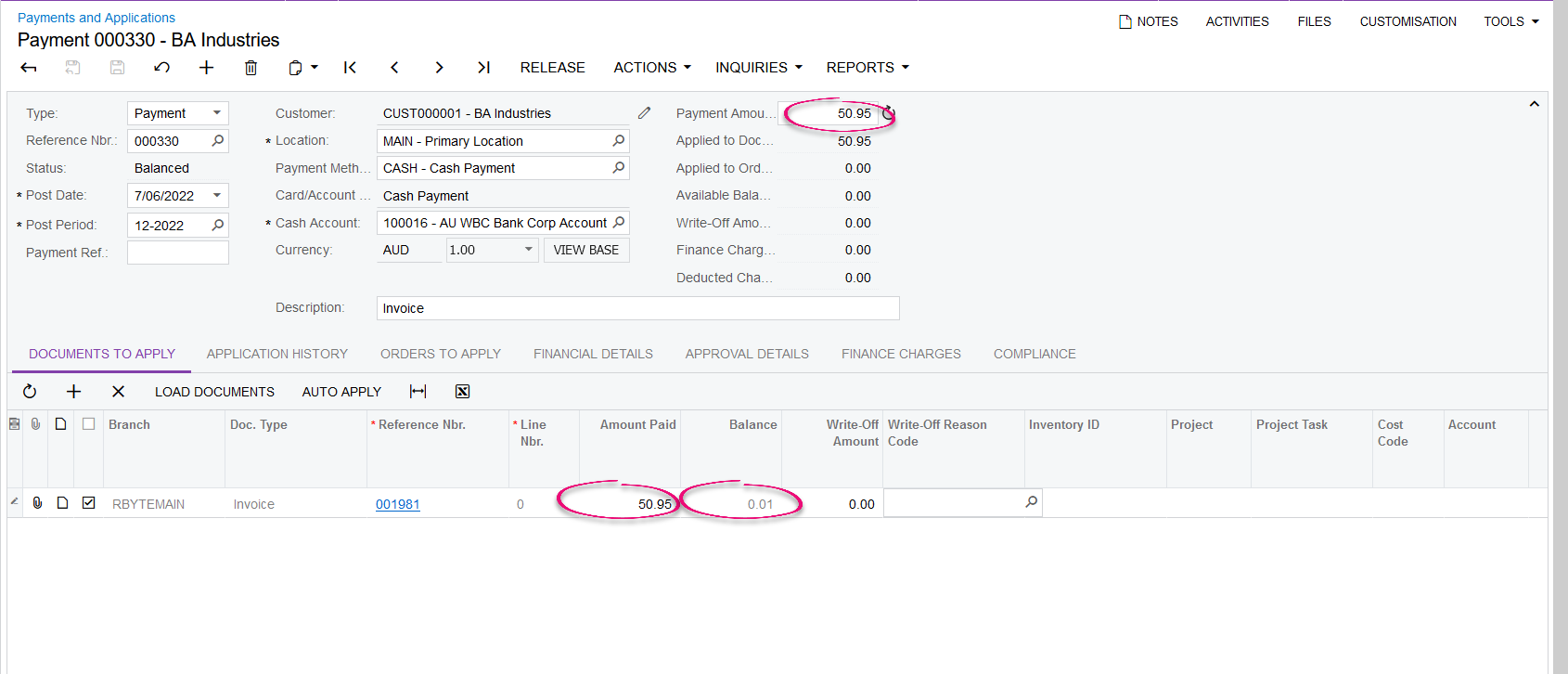

When you receive a cash payment of $50.95 from the customer, enter the payment of $50.95 into the system and apply against the invoice. As you can see, the system shows that the invoice still has a 0.01 balance.

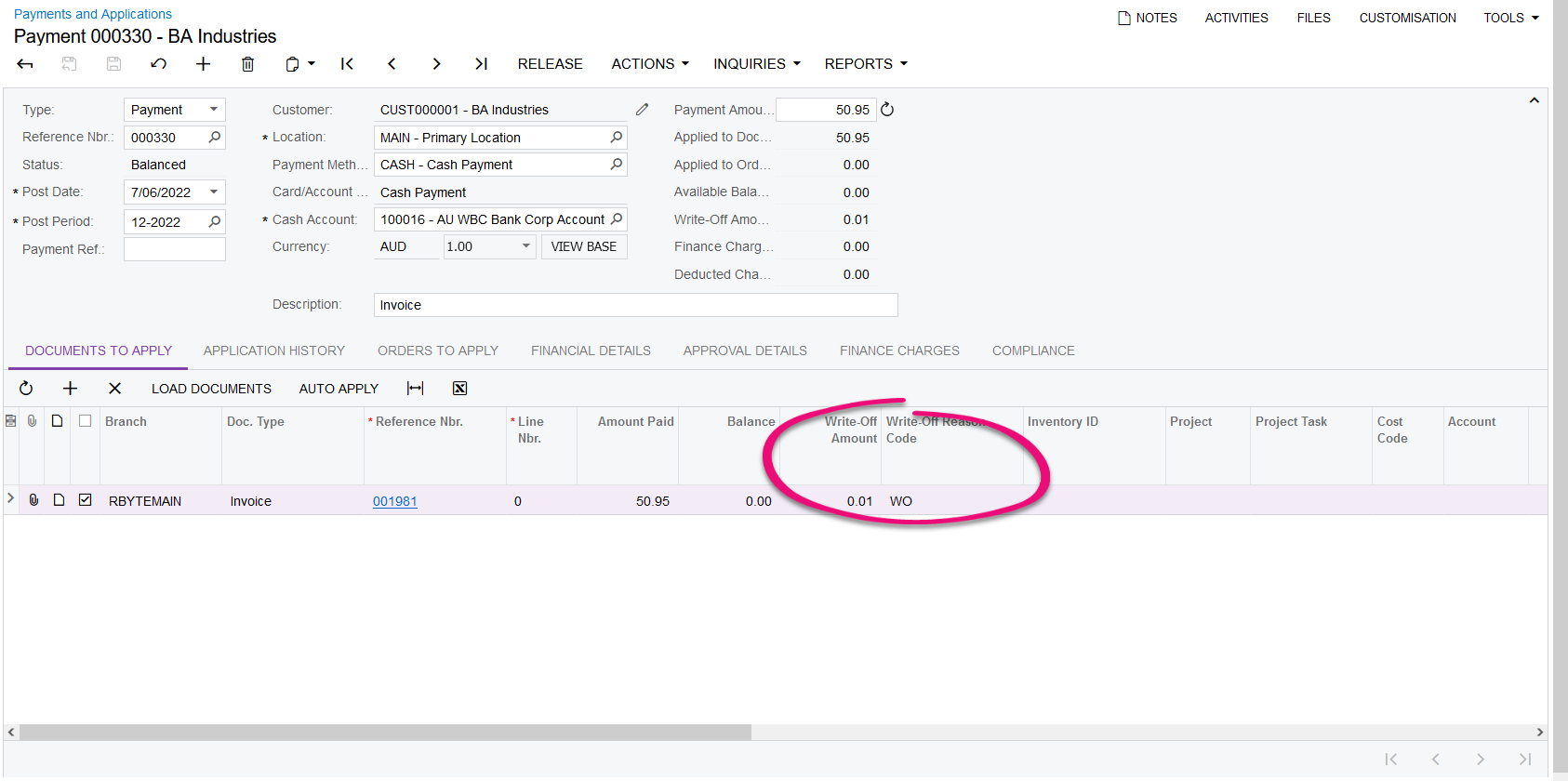

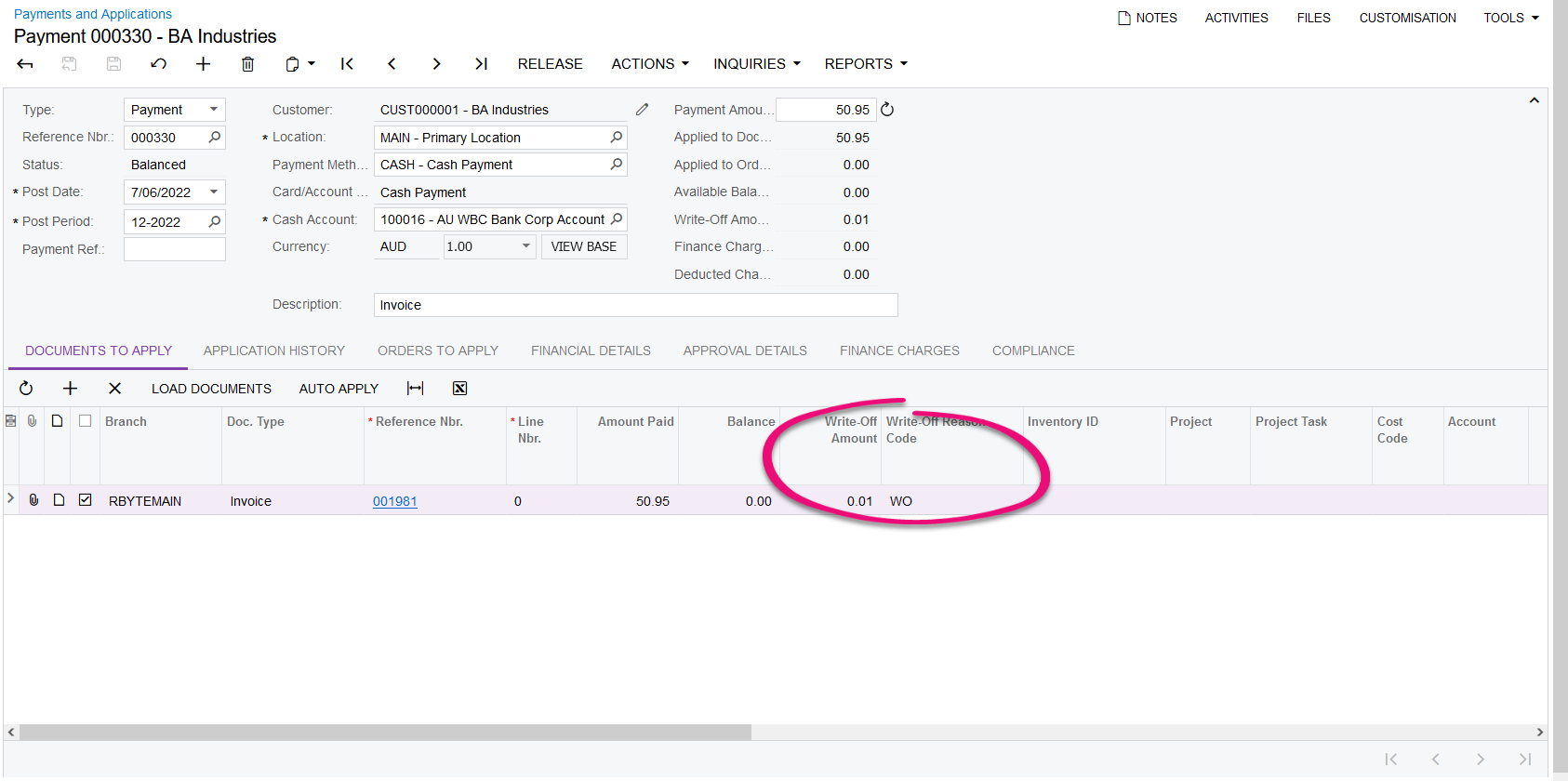

When you accept the $50.95 cash payment from the customer, technically you’re writing off the 0.01 balance for the invoice. Therefore, in the Write-off amount, specify 0.01 to write-off the one cent remaining for this invoice. Specify a write off reason code:

After you release this Payment, both the Invoice and Payment will be closed. No further action required.