How superannuation payments creates general ledger entries – clearing house compared to direct payment

This page is for MYOB Acumatica consultants

Check all changes in a test environment before taking them live. Make sure all related features still work as expected and that your data is unaffected.

This knowledge base article discusses the GL Entries created during the paying of Superannuation, and explains to you the different behavior and process when you are paying Superannuation using different methods:

- Pay directly to the Superannuation Companies, using the Batch Payment process.

- Pay through a Super Clearing House using the SAFF/PaySuper method.

Build 2021.117.400.6951 [21.117.0037] onward.

Firstly, let’s discuss the GL Entries related to Superannuation. When you finish a Pay Run, the following entries will be created:

|

GL Accounts |

Debit |

Credit |

|

Superannuation Payable |

X |

|

|

Superannuation Expense |

X |

The second GL Entry is recorded after you have submitted the payment to the superannuation companies or the super clearing house:

|

GL Accounts |

Debit |

Credit |

|

Superannuation Payable |

X |

|

|

Cash Account |

X |

However, depending on which way you pay, the system will different behaviors:

- If you’re processing a Batch Payment to pay directly to the Superannuation Companies. That is, after you create a Superannuation Batch, and select Submit Payment

After which, the system creates a Batch Payment:

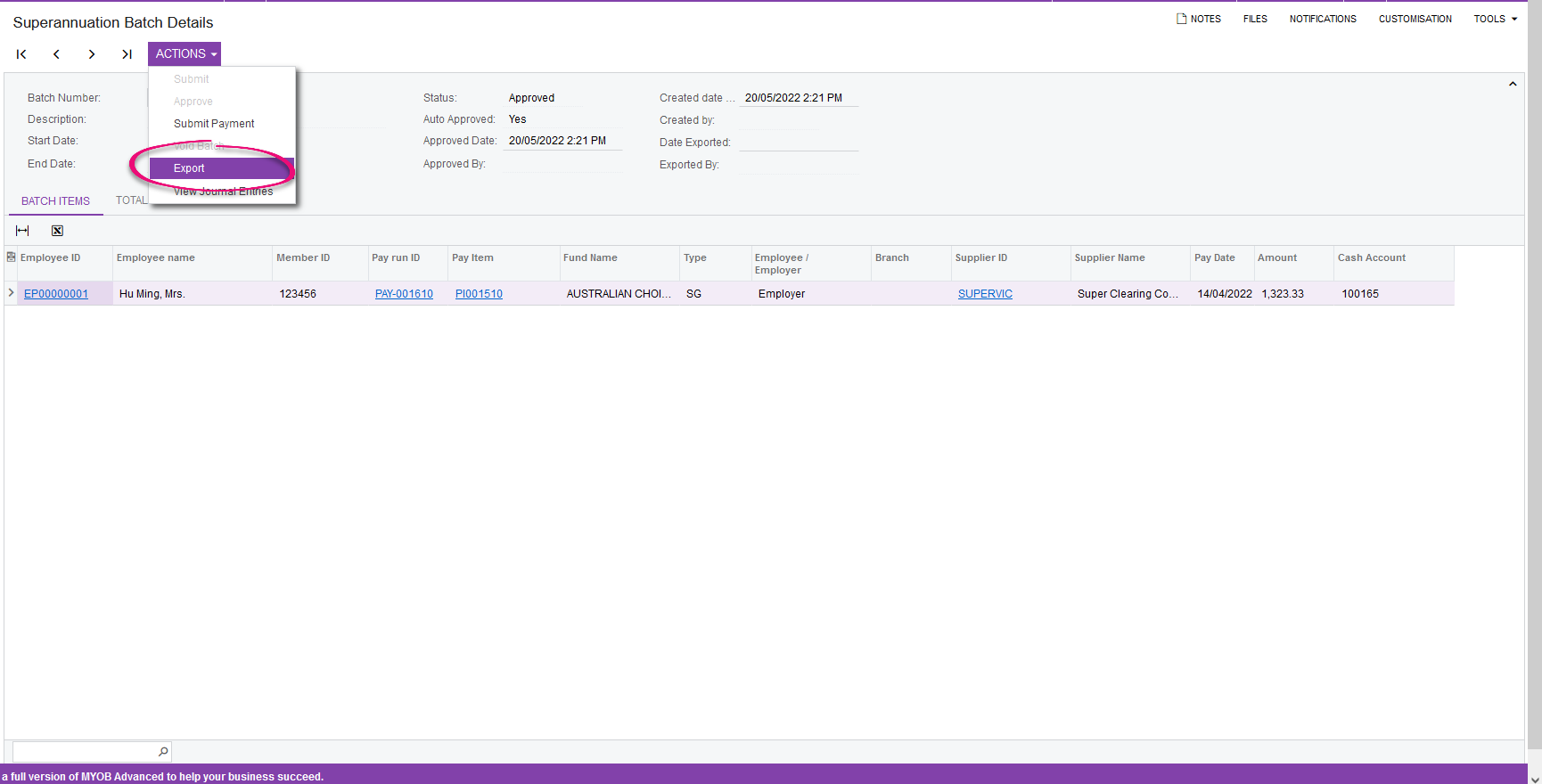

By exporting this Batch Payment (ABA file), the system automatically creates the second GL Entry above (Debits superannuation payable and credits cash account).

- If you’re processing the Superannuation Batch through SAFF or PaySuper, that is, exporting the SAFF file (or Authorise if using PaySuper):

Then, the second GL entry is not automatically created. Users will have to manually create a GL Entry that debits superannuation payable and credits cash account.