Creating a salary packaging pay item to use for a novated lease (AU)

A novated lease is a way you can finance a new or used car. Employees can make repayments from their pre-tax salary with approval from the employer under a ‘salary sacrifice' or ‘Salary Packaging’ arrangement. This can effectively reduce the employee’s taxable income.

Novated Lease payments are direct debited monthly from the Employers account. These transactions are consolidated payments for all employees participating in this process. The normal cycle of these payments are monies are deducted from employee pays, and the employer would pay monthly (12) payments to the finance company for the total amounts owing.

Jenny has $500 per month deducted from her salary. She is paid fortnightly, so $250 per pay must be withheld. The Novated Lease company would invoice the Employer monthly, and the employer would pay this debiting the nominated Novated Lease Account.

-

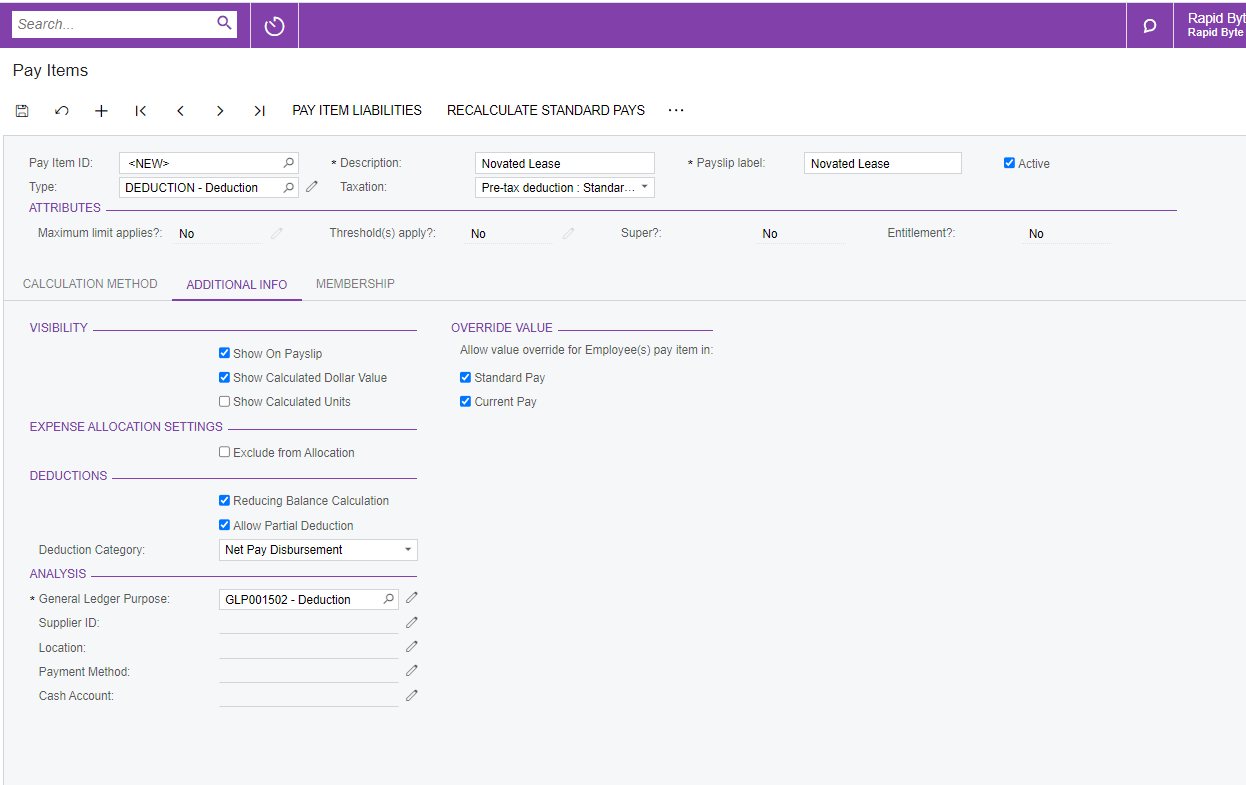

On the pay items screen you’ll need to create a new Pay Item (Payroll>Pay Item Configuration>Pay Items)

-

If your Pay Item has <NEW> as the Pay item ID you can leave this field and it will automatically populate when saved - if this field is blank please enter a Pay item description

-

Pay Item Type must be selected as a deduction and you will also need to add a description for the pay item and the payslip label

-

Change the Tax to Pre-Tax Deduction Standard PAYG this is because the novated lease is to be deducted based on the Employee’s gross pay prior to any tax being deducted.

-

Calculation Method Tab:

-

Amount - The default dollar amount of the pay item. This can be left at $0.00 and edited when the pay item is added to an employee.

-

Per -The frequency of the pay item. In cases where the frequency is different from the frequency of the pay group that the pay item appears in, it will be applied proportionately, e.g. if the pay item specifies an amount per fortnight and appears in a weekly pay group, the value will be halved

-

-

Additional Info tab

-

Visibility select how you would like this deduction to be displayed on the employee’s payslip

-

Override Value Select the options if you would the value to be overridden

-

Expense Allocation Settings choose whether or not expenses related to the pay item can be allocated to GL accounts and/or projects

-

Deductions

-

Reducing Balance Calculation - tick this option if there is a total balance of the deduction and the amount will reduce each pay run until the balance is nil

-

Allow Partial deduction - This option determines how the system should behave when an employee’s pay is not sufficient to allow this deduction to be made in full:

-

If this option is ticked, then partial deductions of this pay item can be made, i.e. if the employee’s pay is insufficient to make the full deduction, then the deduction amount will be the remaining balance of their pay.

-

If this option is not ticked, then if the employee’s pay is

-

-

Deduction category - this must be Net Pay Disbursement

-

-

-

Analysis - The General Ledger Purpose must be selected, the general ledger purpose will determine how it should behave when being posted to GL journals. If you are unsure what GL Purpose you should be selecting then please seek advice from your accountant.

For instructions on how to add this to the employees pay please refer to this article https://help.myob.com/wiki/display/advppl/Adding+pay+items+to+an+employee%27s+standard+pay+details