Using the Bonuses Feature to Instantly Write Off a Fixed Asset

This page is for users who understand the fixed asset module in MYOB Acumatica. You need to know how to:

- create a fixed asset class and fixed asset

- reconcile, calculate and depreciate fixed asset.

To make sure your data is compliant with tax agency requirements, consult with a certified professional for treatment of fixed assets.

If your company has two or more books for fixed assets, the bonuses feature lets you instantly write off a fixed asset in one of your books, while also depreciating the asset over its useful life in another book.

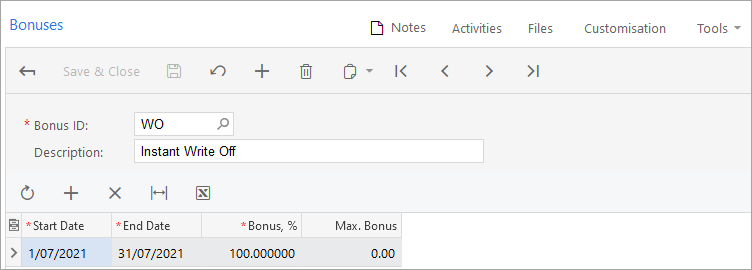

The Bonuses form (FA208000) lets you create an unlimited number of bonuses, each with different settings—like the bonus rate and the maximum bonus amount. A bonus is applied to an asset if the start depreciation date is within the specified date range for the bonus.

Example of the bonuses feature

A company has the bonuses feature set up in MYOB Acumatica. They purchase an executive car as a fixed asset for $100,000. The Receipt Date and Placed In Service Date are 01/07/2021. The depreciation of this fixed asset is recorded in two depreciation books: a posting book and a non-posting book. The first depreciation period starts from 01/07/2021 to 31/07/2021

During the first depreciation period, the company instantly write off the executive car in their non-posting book, while letting the executive car depreciates over its useful life in their posting book.

Depreciating the fixed asset with bonuses

After instantly writing off the fixed asset, the company uses the Calculate Depreciation screen to run depreciation for the first fixed asset period (01/07/2021 — 31/07/2021).

The company reviews the depreciation history of the fixed asset. They notice that for the posting book, the depreciation is spread across the useful life (in the first period, the fixed asset only depreciates $1,666.67). However, for the non-posting book, with the bonuses code specified, then 100% of the fixed asset cost ($100,000.000) is fully depreciated in the first period.

Setting up the bonuses feature

-

Go to the Bonuses form (FA208000).

-

On the toolbar, click the New Record plus icon (

) to create new bonuses code.

) to create new bonuses code. -

To write off 100% of the cost of the fixed asset, complete the bonus code fields as follows:

Remember, as per the requirement, the fixed asset needs to be written off in the first depreciation period.

-

Bonus ID: Enter an ID that makes sense to you.

-

Description: Enter a description that makes sense to you.

-

Start Date: 01/07/2021

-

End Date: 01/07/2021

-

Bonus, %: 100

-

-

Go to the Fixed Asset Classes screen (FA201000).

-

On the toolbar, click the New Record plus icon (

) to create a new fixed asset class.

) to create a new fixed asset class. - Complete the necessary fields for the new fixed asset class.

- On the Depreciation Settings tab, in the row for your non-posting book, select the Bonus checkbox. For example, in the image below, the non-posting book is called TAX.

- Go to the Fixed Assets screen (FA303000).

-

On the toolbar, click the New Record plus icon (

) to add a new fixed asset.

) to add a new fixed asset. - Complete the necessary fields for the new fixed asset.

- On the General Settings tab, in the Asset Class field, enter the fixed asset class you created in step 5.

- On the Balance tab, in the Bonus field for your non-posting book, select the bonus code you created in step 1.

- To instantly write off the fixed asset:

- Take the fixed asset off hold.

- Reconcile the fixed asset.

- If required, release any fixed asset transactions from MYOB Acumatica.