Creating a redundancy pay item (NZ)

Whether employees receive redundancy payments is dependent on the applicable employment agreements and is a matter for negotiation between the parties.

If you need to pay out a lump sum figure for an employee becoming redundant then you will need to create a new pay item for this in the system.

For online resources pertaining to redundancies please refer to the following links:

https://www.employment.govt.nz/ending-employment/redundancy/

https://www.govt.nz/browse/work/leaving-a-job/redundancy-last-pay/

https://www.ird.govt.nz/employing-staff/payday-filing/non-standard-filing-of-employment-information/lump-sum-payments

https://www.business.govt.nz/tax-and-accounting/basic-tax-types/acc-levies/

Creating the pay item

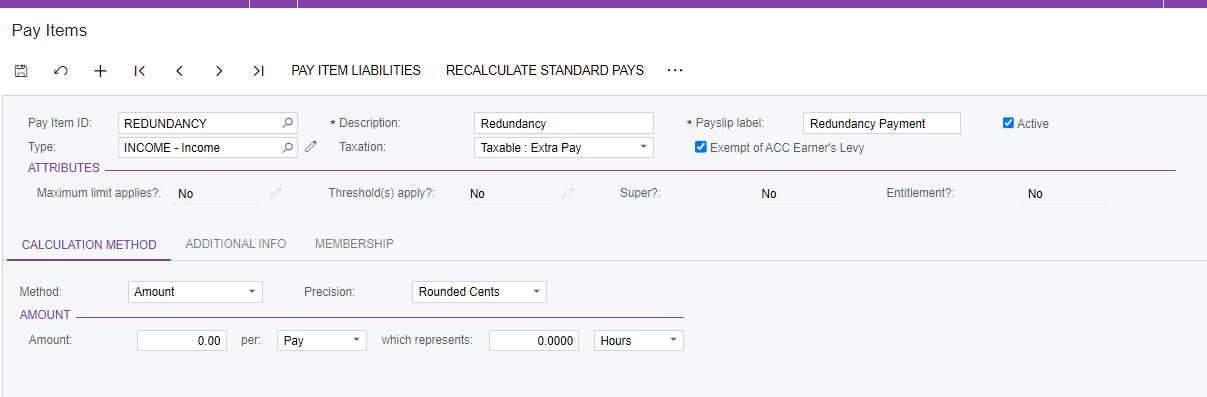

Go to the pay items screen and create a new Pay Item (Payroll > Pay Item Configuration> Pay Items)

If your Pay Item has <NEW> as the Pay item ID you can leave this field and it will automatically populate when saved - if this field is blank please enter a Pay item description

The Type of the Pay Item should be set to Income

Enter the Description and Payslip Label as required

Taxation should be selected as Taxable: Extra Pay

Exempt of ACC Earner's Levy should be selected

On the Calculation Method tab leave the settings as is:

Additional Info Tab here you need to select the relevant choices for the Visibility, and Expense Allocation Settings - your selection here will be company specific. You must select a General Ledger Purpose for the pay item, if you are unsure you can seek financial advice from your accountant.

Check the Pay Item Liabilities to ensure what has been chosen is correct - you can modify these as required. If you are unsure on what needs to be selected please seek external independent advice.

Once this has been created you can refer to the section called “Create a Pay for the termination” in the White Paper for NZ terminations https://help.myob.com/wiki/display/adv/Processing+payroll+terminations+-+NZ#