Setting up a deduction for a Ministry of Justice fine (NZ)

If you’ve received a letter from the ministry of justice indicating that you’ll need to start deducting the balance of a fine from an employees wages you’ll need to follow these steps to ensure you can do this in MYOB Acumatica. For additional information you can vists https://www.justice.govt.nz/fines/about-fines/employers/

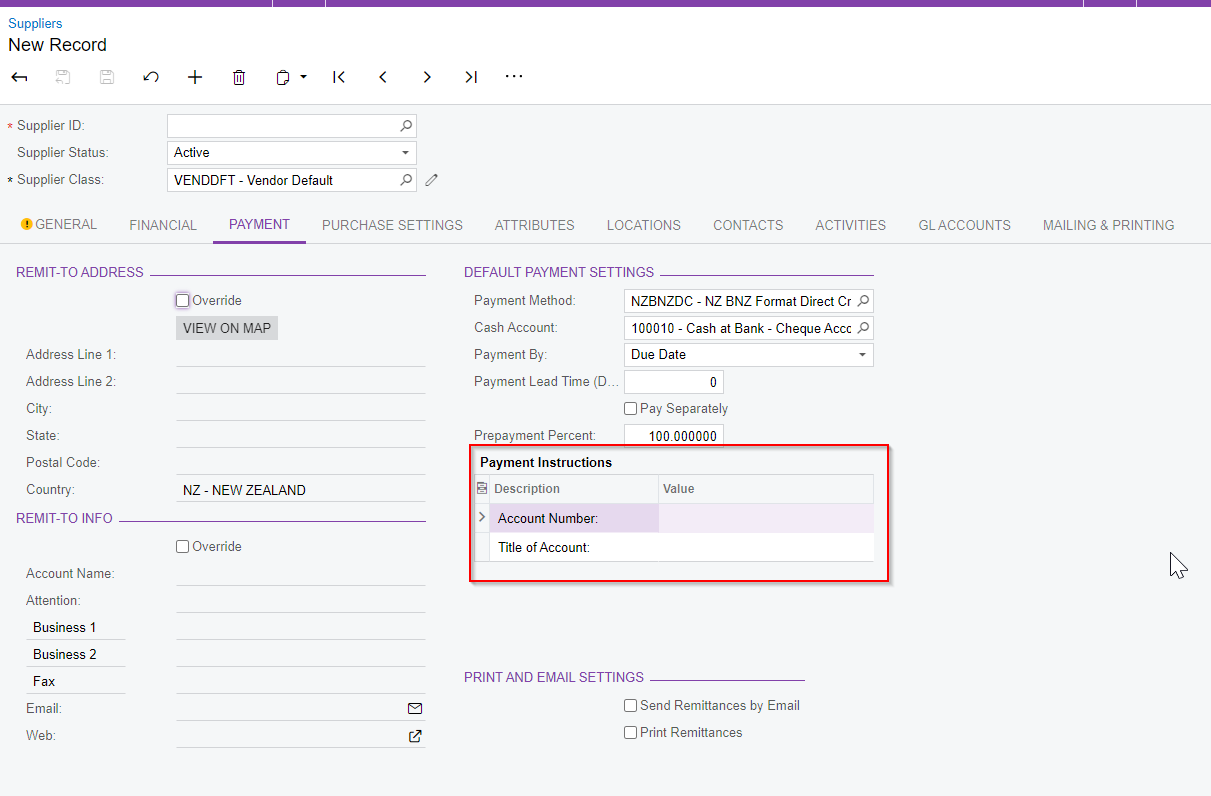

First you will need to be sure that you have the supplier for MOJ set up in your system and you will need to be sure the supplier has payment instructions set

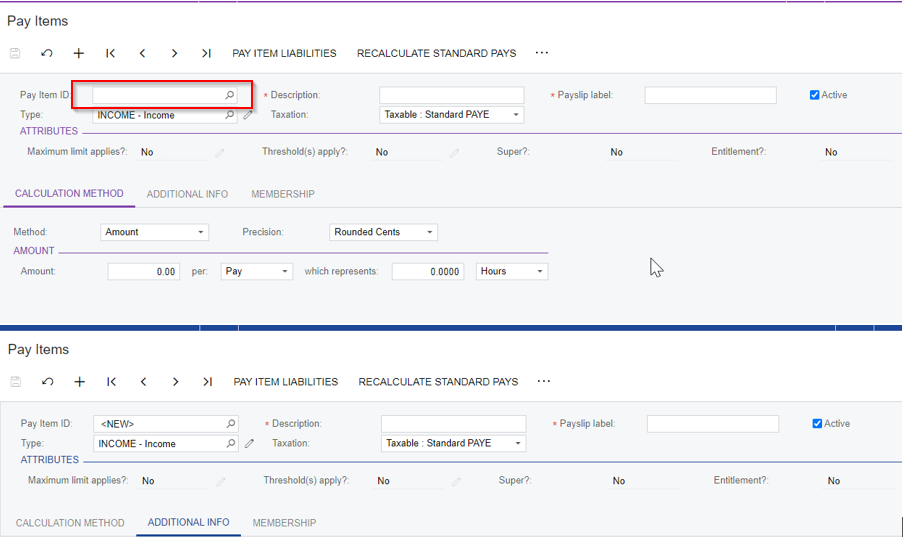

Now you’ll need to create a new Pay Item (Payroll>Pay Item Configuration>Pay Items)

If your Pay Item has <NEW> as the pay item ID you can leave this field and it will automatically populate when saved - if this field is blank please enter a pay item description

You’ll need to enter a description on the pay item and the payslip label

Pay Item Type needs to be set as a deduction - this automatically updates the tax to be Not Taxed - Normal After Tax deduction

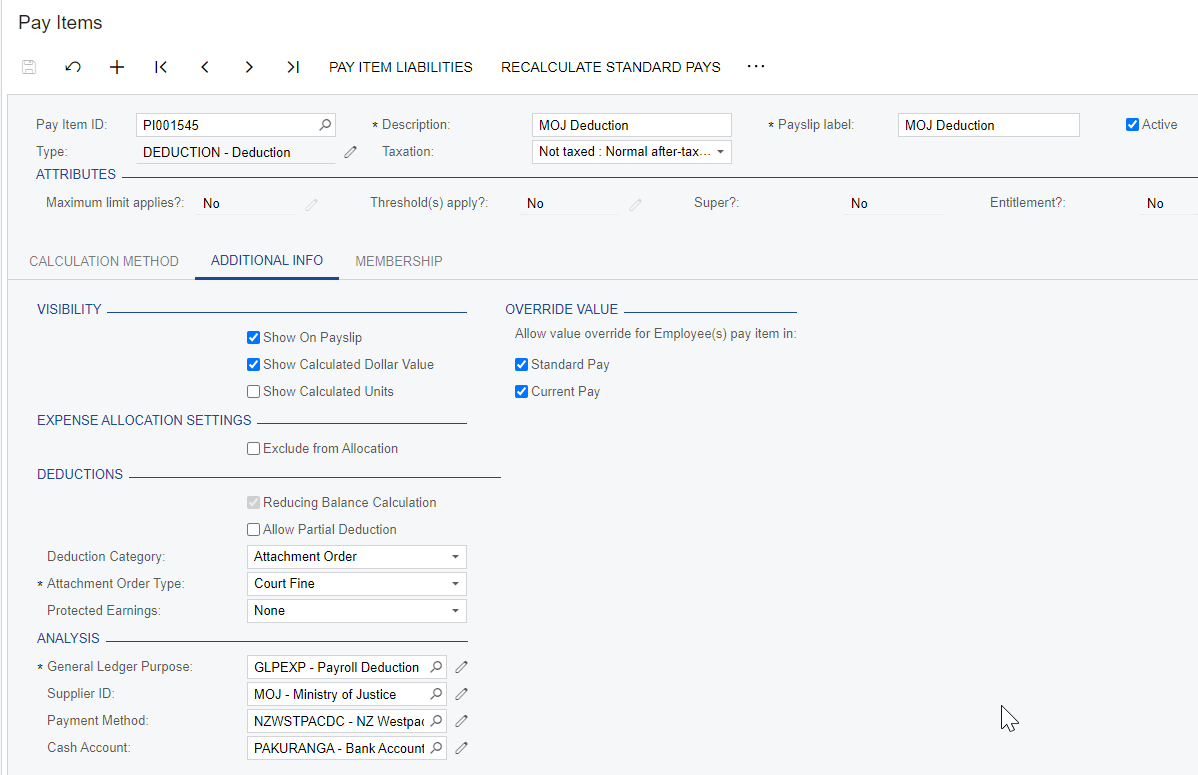

On the additional info tab

You can choose the visibility settings that you require

Select the Reducing Balance check box

In the deduction category you’ll need to select Attachment Order - this means you can add a reference number for employees specifically and that it is a priority deduction and will go out before anything else such as staff loans etc

Select a General Ledger Purpose for the pay item, which determines how it should behave when being posted to GL journals

Select the MOJ supplier - this will auto populate the payment instructions

Select the cash account to use in transactions for this pay item. The account can be overridden in employees’ Standard Pays if necessary.

Save your changes

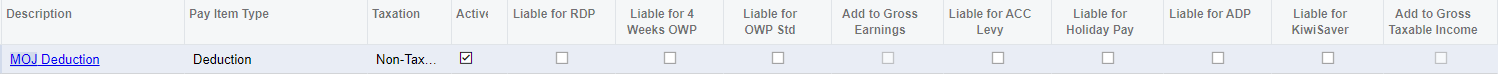

Now click on “Pay Item Liabilities” and ensure that nothing is ticked against your new pay item

Now you’ve set the pay item up you’ll need to add this to your employees pay details

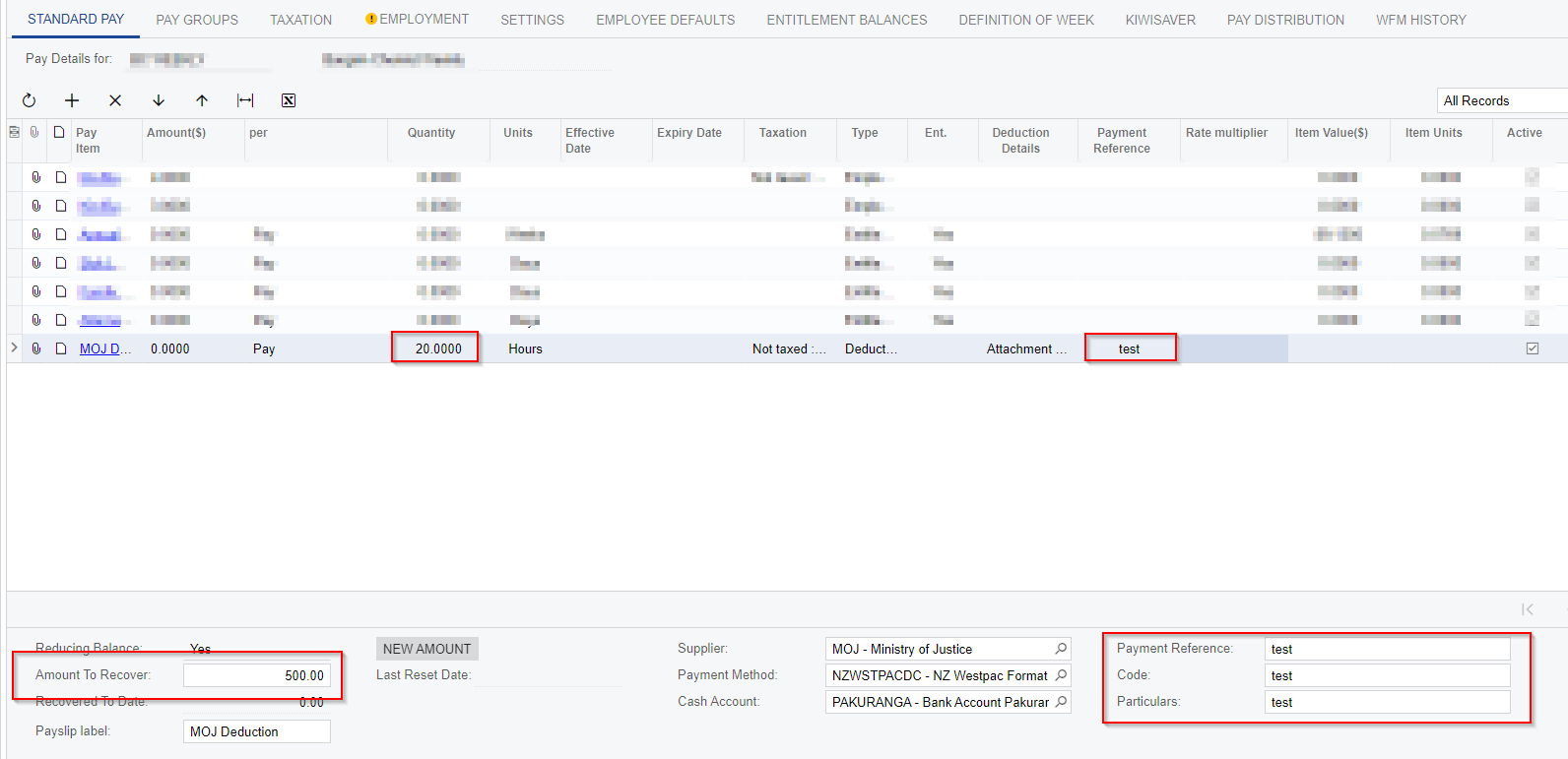

Go to the Pay Details (People>Employees>Pay Details) and enter in the employee who needs to have the deduction added to their pay

On the standard pay tab use the plus symbol to add a new line, in the new line please select your new pay item - if you try to save the pay item you will get an error, If this happens that’s fine you can click OK to the error message and manually add in the payment reference required

Please enter in the Payment reference, Code & Particulars required this can be found at the bottom of the screen when you have highlighted the pay item

Enter the total amount to recover

In the quantity field enter the amount that will be deducted from the employees pay for each pay period

Save your changes