Opening balance for cash-based GST customers

This page is for MYOB Acumatica consultants

Check all changes in a test environment before taking them live. Make sure all related features still work as expected and that your data is unaffected.

MYOB Acumatica caters for both Accrual-basis GST recognition method and Cash-basis GST recognition method. While it is pretty straight forward when migrating customers using Accrual-Basis GST recognition from a legacy system to MYOB Acumatica, it can get a little tricky with Cash-basis GST recognition because GST is not recognized until invoices are paid. In some scenarios, customers might have invoices created in the past, but paid in the Tax Period of go live (before the Go Live date), and we need to recognize GST for these invoices/payments without doubling up the Income/Expense and Pending GST amount that have already been migrated through the trial balance. This knowledgebase article will discuss how to handle this situation.

These instructions are for MYOB Acumatica builds 2021.117.400.6951 [21.117.0037] onward.

REQUIREMENTS:

Demonstrate opening balance process for Cash-based GST (Payment Basis GST) customers using the following conditions:

-

Customer’s financial year starts from 01st of July to 30th of June next year.

-

Customer prepares and reports BAS quarterly

-

First BAS period is between 01st of July to 30th of September

-

SCENARIO A: Clean Go-Live. Customer wants migration of unpaid AP and AR Invoices on Go Live date, which is also the start of the BAS period.

-

SCENARIO B: Go-Live date is in the middle of BAS period. Customer has unpaid AP and AR Invoices, also historic AP and AR Invoices that were paid in the current BAS period, before go-live date.

SCENARIO A

Clean Go-Live. Customer wants migration of unpaid AP and AR Invoices on Go Live date which is also the start of the BAS period.

This is an ideal scenario which you and the customer should consider, because it is the simplest method which also reduces user errors or mistakes. Suppose your customer wants to go live on the 1st of July. The BAS period starts from 1st of July to 30th of September. Suppose the customer has the following open documents:

-

AR Invoice of $110 ($100 income and $10 GST) – unpaid

-

AP Invoice of $110 ($100 expense and $10 GST) – unpaid

These are the entries for Open AR Invoice:

|

DR |

CR |

|

|

AR |

110 |

|

|

Income |

100 |

|

|

Pending GST Collected |

10 |

These are the entries for Open AP Invoices:

|

DR |

CR |

|

|

AP |

110 |

|

|

Expense |

100 |

|

|

Pending GST Paid |

10 |

So to bring those documents in, you only need to:

-

Post the GL Entries of the open AP/AR Invoices using the Trial Balance

-

Turn on Migration Mode in AP/AR Preferences, and enter or import the unpaid AP/AR Invoices into the system, with the exact Tax Category, Tax Zone and Tax IDs as if these documents were entered when after opening balance (when the users start using the system)

-

Turn off migration mode when done.

-

When it’s time to pay the invoices, the user only needs to enter new payments and apply them against the invoices. At the end of the BAS period, the GST component of paid invoices will be recognized.

SCENARIO B

Go-Live date is in the middle of BAS period. Customer has unpaid AP and AR Invoices, also historic AP and AR Invoices that were paid in the current BAS period, before go-live date.

This scenario is trickier, BAS period starts from 1st of July to 30th of September, customer wants to go live on 1st of August, which is in the middle of the BAS period. Additionally, they also have the following documents:

-

AR Invoice of $110 ($100 income and $10 GST) – unpaid (Same as scenario A)

-

AP Invoice of $110 ($100 expense and $10 GST) – unpaid (Same as scenario B)

-

AR Invoice of $220 ($200 income and $20 GST) – Created in January, paid in July – before Go Live Date

-

AP Invoice of $220 ($200 expense and $20 GST) - Created in January, paid in July – before Go Live Date

As you can see, if all 4 invoices are fully paid by the end of the BAS quarter, then the BAS you should contain the GST amounts from all four payments of the above invoices. While you would handle unpaid AR and AP Invoice 1 and 2 exactly like scenario A, the way you handle invoice 3 and 4 are different, because you need to consider the following:

-

Both invoice 3 and 4 are paid, so their balances are cleared in the AP and AR subledger (no AP and AR balance for these invoices)

-

The income and expense for these invoices will have already been imported through the Trial Balance

-

The Pending GST Payable and Claimable amount of these invoices will have already been imported through the Trial Balance.

-

The Payments of these invoice need to exist in the month of July when they were paid, because we need the GST amount to go into the BAS by the end of the BAS period – and because of this, we also need to recreate these invoices to apply and close off these payments. While we re-create these invoices and payments, we need to ensure that we are not doubling up the Income, Expense and Pending GST that we imported through the trial balance.

To satisfy the above requirements, you need to do the following:

-

Ensure Migration Mode is off in AR and AP Preferences.

-

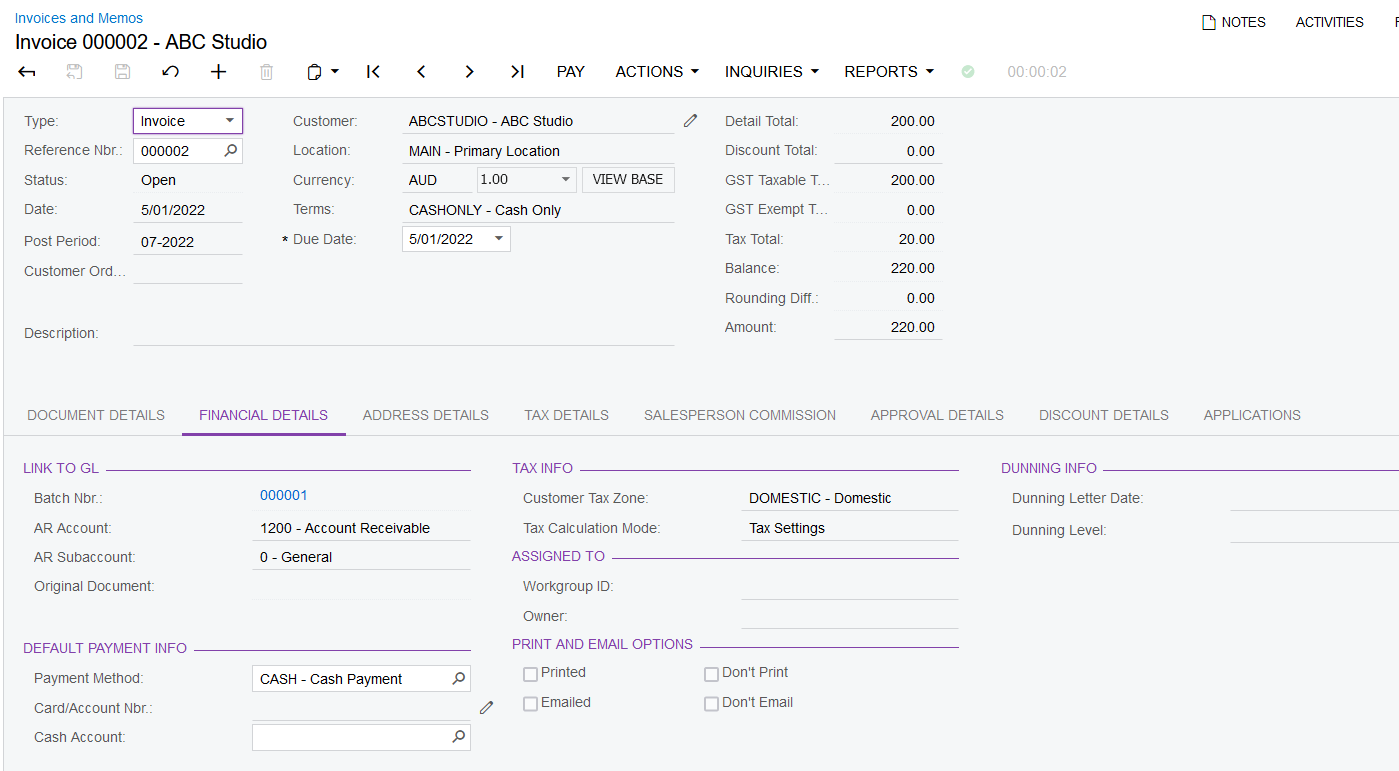

Import or enter AR Invoice 3 (back dated to January when it was created). – there will be no GL Batch created when you release this AR invoice because you’re in migration mode – the Tax Zone, Tax Category and Tax ID are the same as if this invoice is entered after opening balance.

-

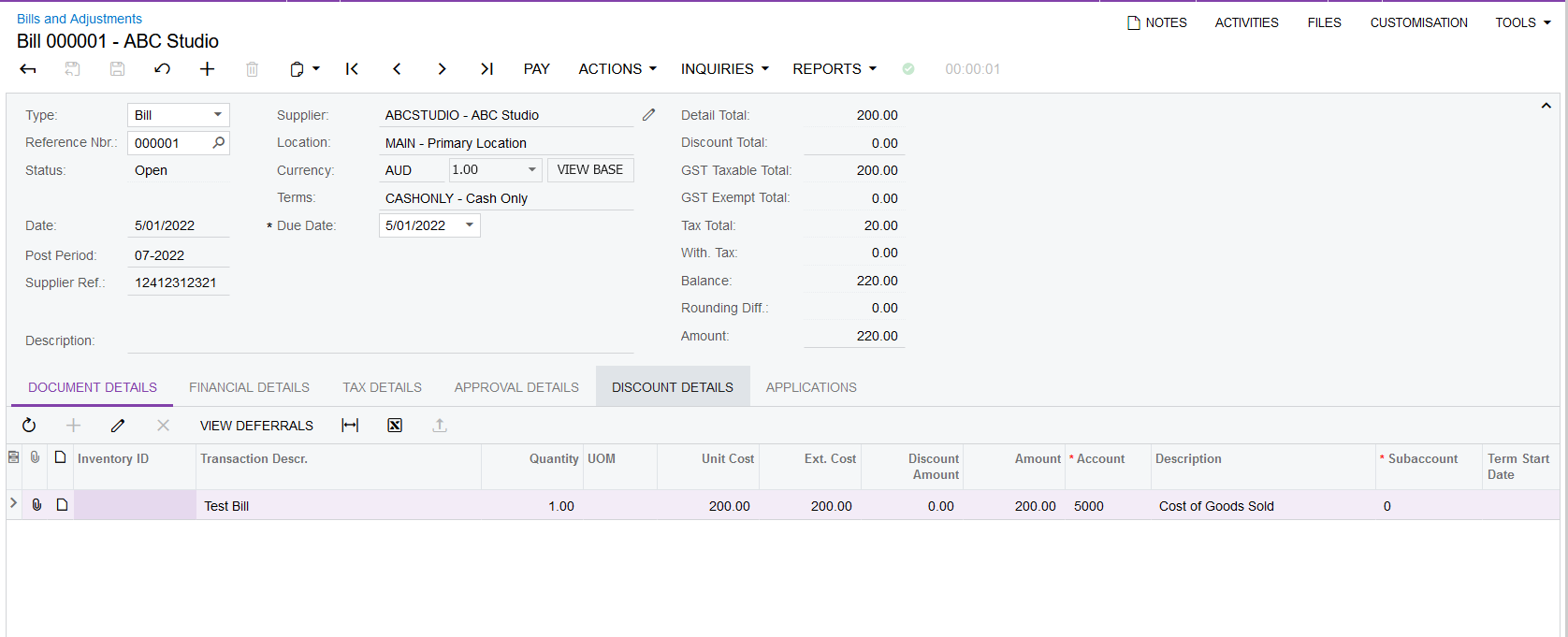

Import or enter AP Invoice 4 (back dated to January when it was created) – there will be no GL Batch created when you release this AP Invoice because you’re in migration mode - the Tax Zone, Tax Category and Tax ID are the same as if this invoice is entered after opening balance.

-

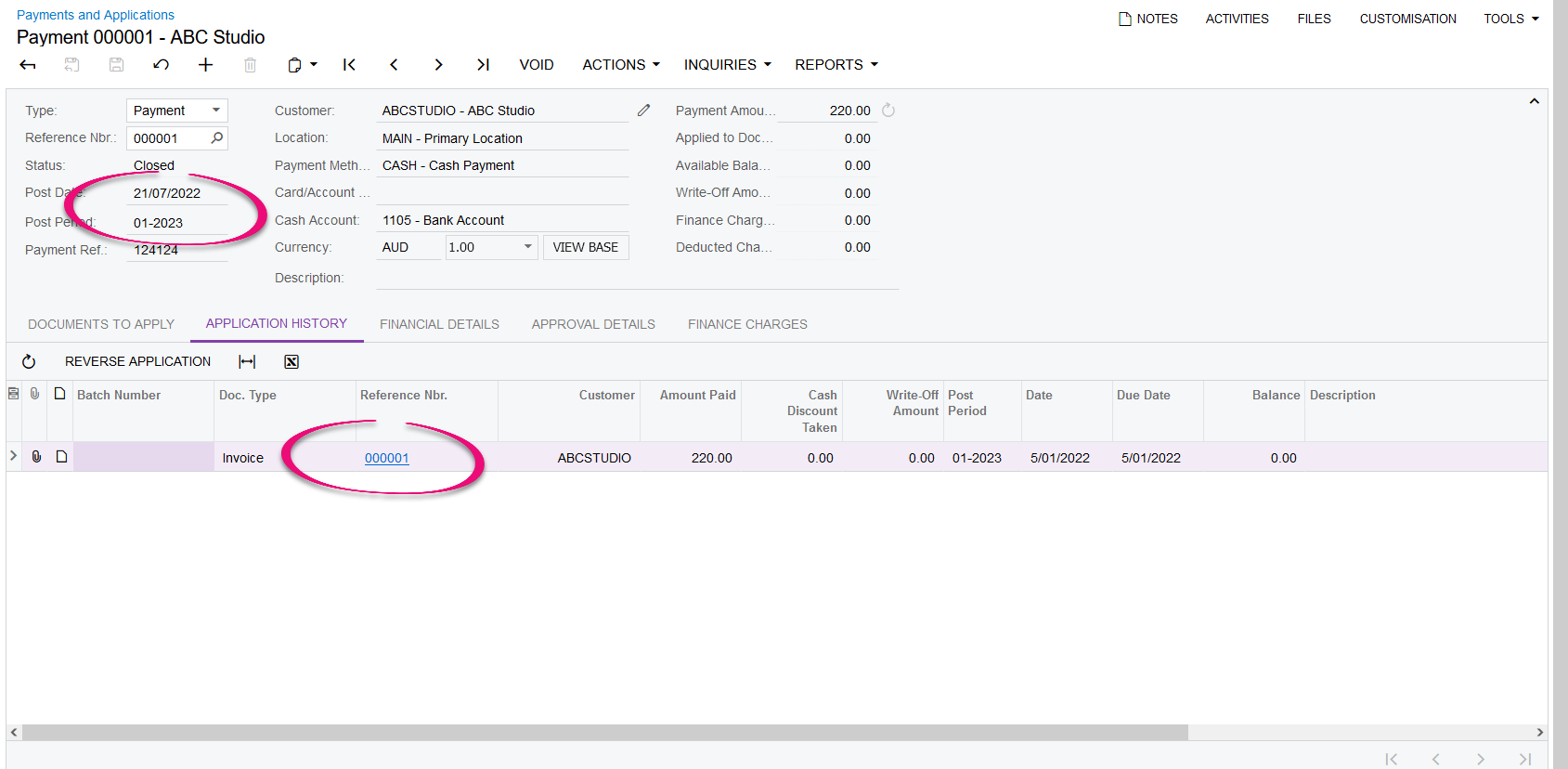

Import or enter an AR Payment for AR Invoice 3, backdated to July (part of this BAS – make sure the date belongs to this BAS, otherwise you won’t be able to recognize the GST after) and applied it on the open AR invoice. Then release while it’s applied against the AR Invoice:

-

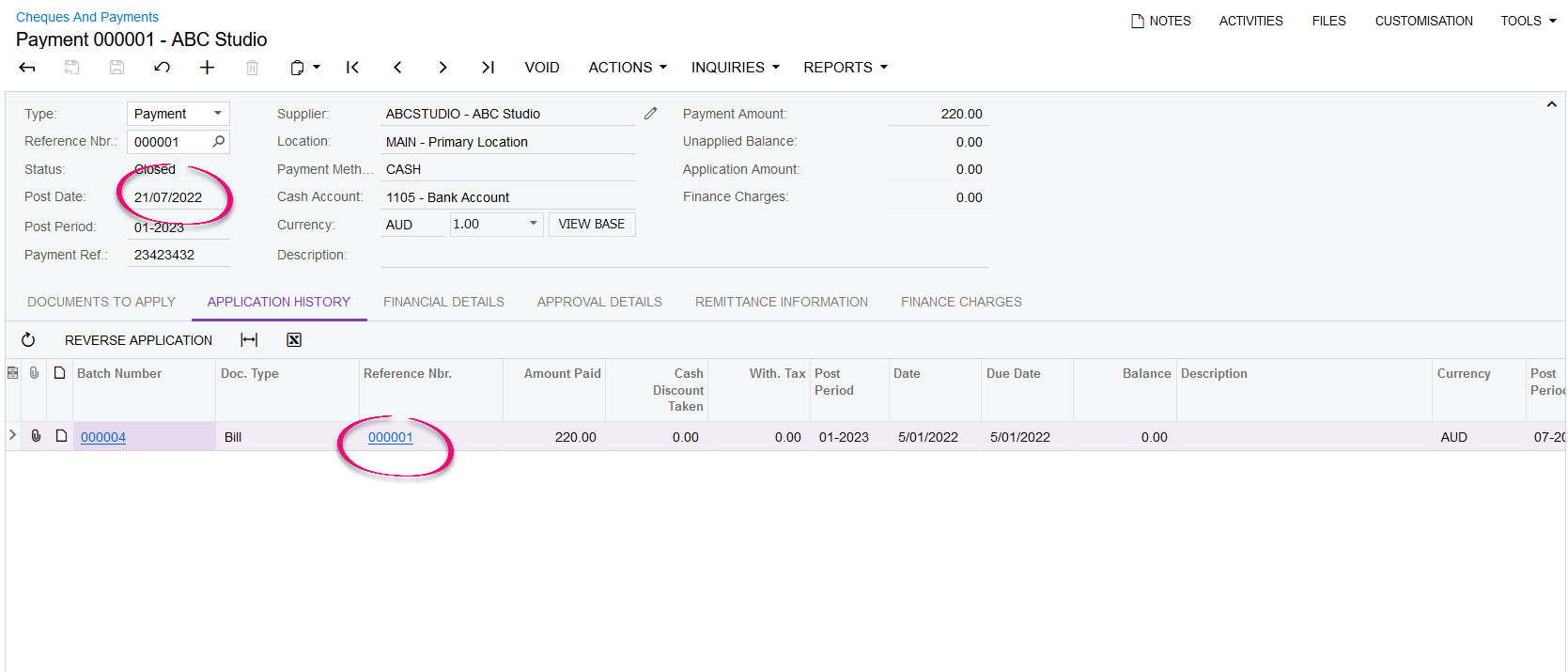

Import or enter an AP Cheque for AP Invoice 4, backdated to July (part of this BAS – make sure the date belongs to this BAS, otherwise you won’t be able to recognize the GST after) and applied it on the open AP invoice. Then release while it’s applied against the AP Invoice:

-

Reverse all the GL Batches that were generated from all the steps above (so that it doesn’t double up the amount in GL which we have already imported through the Trial Balance)

-

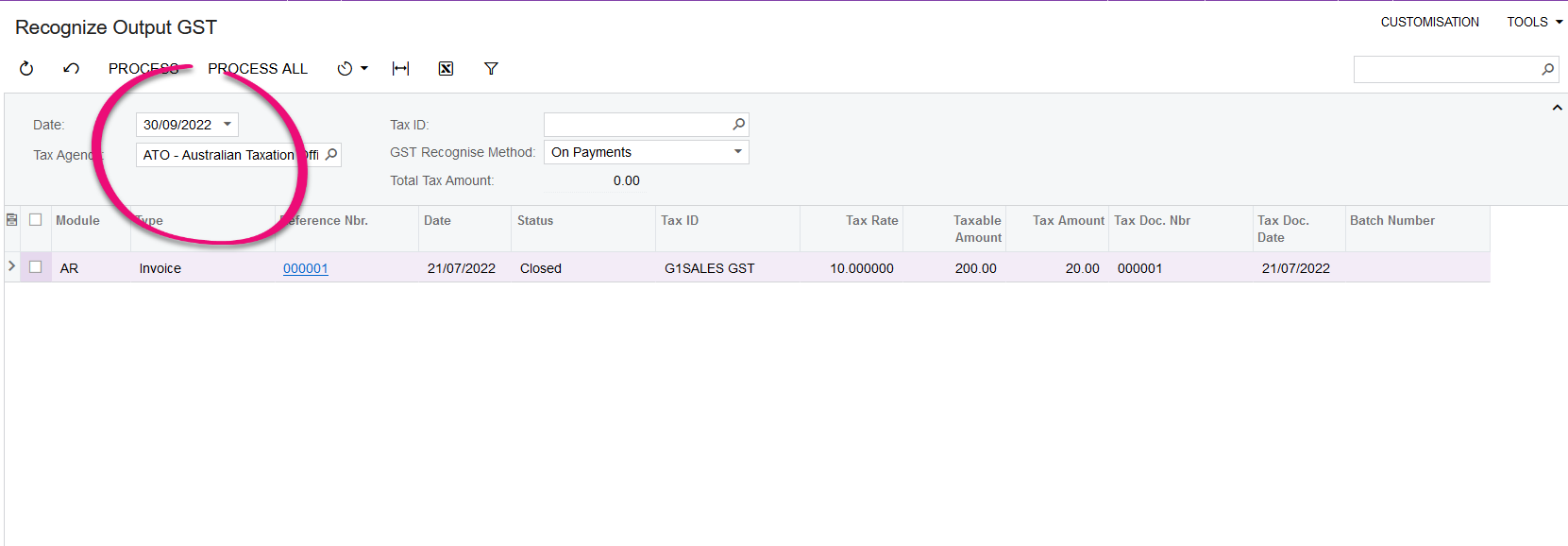

At the end of the BAS period, after the Payments will be available for you to recognize, before you can prepare the tax report:

Additional information

If you have an invoice that is half paid, depending on when the first payment was made, you need to handle it differently:

-

If the first payment was made before Go Live and before the current BAS period – then the GST component of that payment would have already been reported to the ATO in the previous BAS period. In this case you only need to enter the open lines (lines that have not been paid because the total of these lines will also match your AR). When you create a payment, the GST component of these remaining lines will be recognised and reported in the current BAS.

-

If the first payment was made within the current BAS Period – the customer still needs to report the GST recognised from this Payment, as well as the GST for the Open amount, so it will be scenario B with some slight changes:

-

Do the below while migration mode is off (will generate GL Batch for each document released):

-

Enter the invoice in full – reverse the GL Batch of the invoice so that it doesn’t inflate your AR, Sales and Pending GST (the amount sitting on pending GST should be the full GST component of the total invoice, because the payment was created within the current BAS period but you have not yet reported BAS for these paid lines). The full GST component of this invoice has already been posted into Pending GST Collected through trial balance

-

Create the first payment – reverse the GL Batch of the payment so that it doesn’t inflate your Cash Account and reduce your AR (these amounts are already posted through trial balance)

-

When the second and subsequent payments comes in, create and release them as per normal, don't reverse anything.

-

At the end of the BAS period just recognise Output GST as per normal, which will recognise all the GST component of this invoice, move them out of Pending GST Collected and move them into GST collected.

-

When you prepare and release the tax report which will result in the AP bill from the ATO supplier, this will clear the GST Collected.

-