Payment reclassification for unidentified payments

This page is for MYOB Acumatica consultants

Check all changes in a test environment before taking them live. Make sure all related features still work as expected and that your data is unaffected.

It's a very common scenario where you receive payments from customers, but you’re not able to identify what the payment is for until a later time. In this case, it’s very common to park that payment in a temporary clearing cash account until the payment can be identified, then reclassify that payment at a later time. This article shows you how to handle this process.

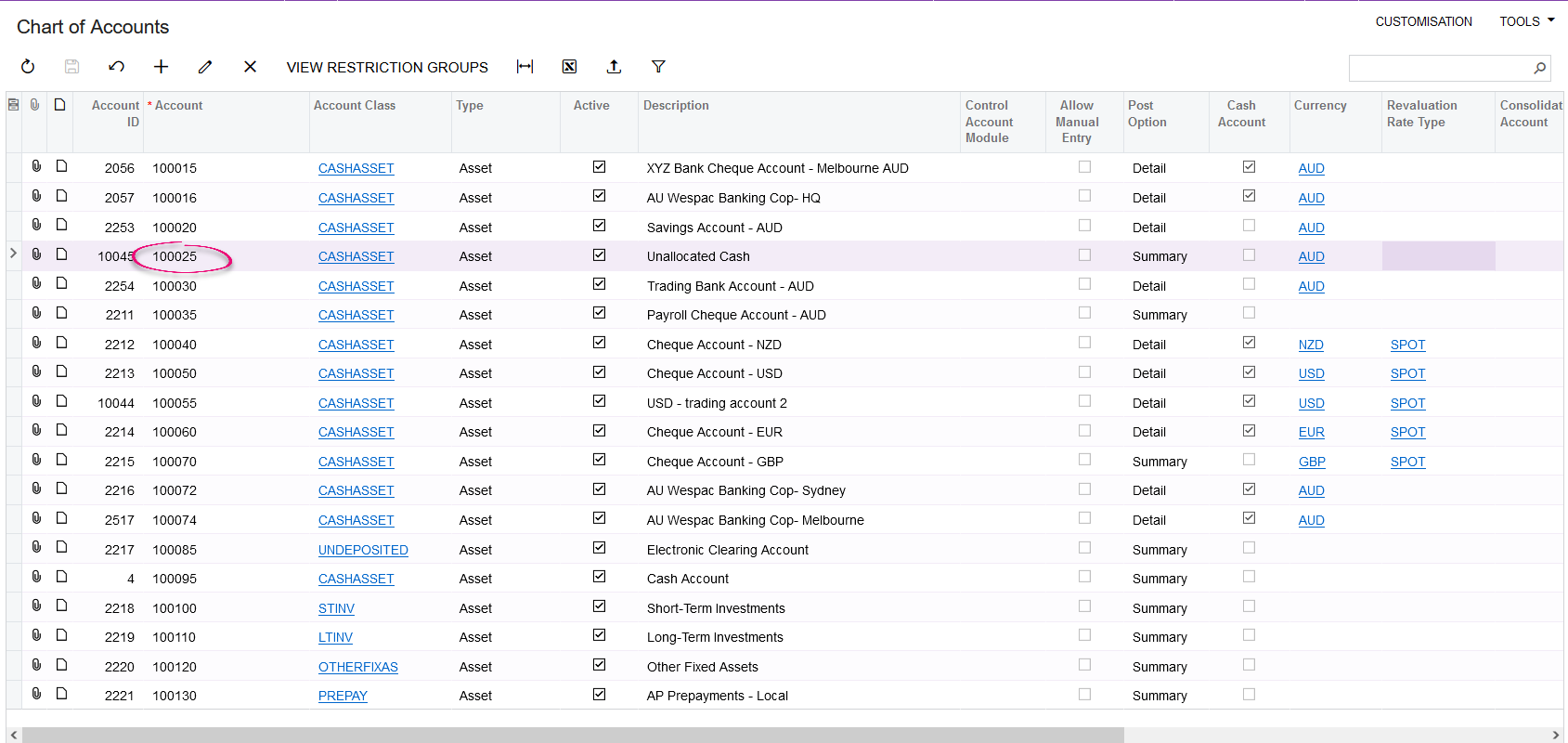

- In the Chart of Accounts screen (GL202500), create a new GL account called Unallocated Cash as a cash clearing account. Assign a currency against this GL account so that it can be later used to create a cash account.

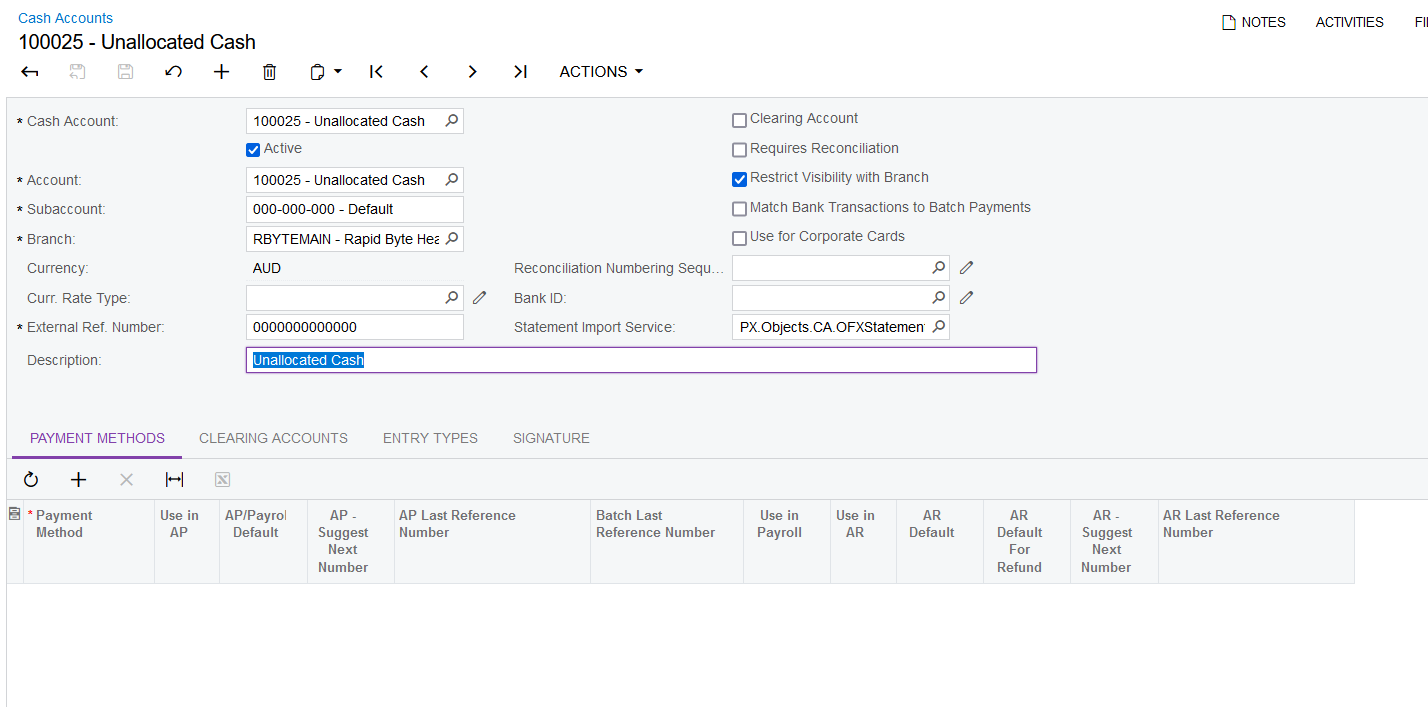

- Go to the Cash Accounts screen (CA202000), create a new cash account and link it with the new GL account.

- Go to the Entry Types screen (CA203000), create a new entry type for unallocated cash. Select Use for Payment Reclassification. In the Reclassification Account field, select the new cash account.

- Open the cash account that you normally use for trading (not the new one you created in step 2). Link the Entry Type with the trading cash account.

- To process an unrecognised payment, go to the Transactions screen in the Banking module. Select the trading cash account you used to receive the unrecognised payment, select the Unallocated Cash entry type and release the transaction.

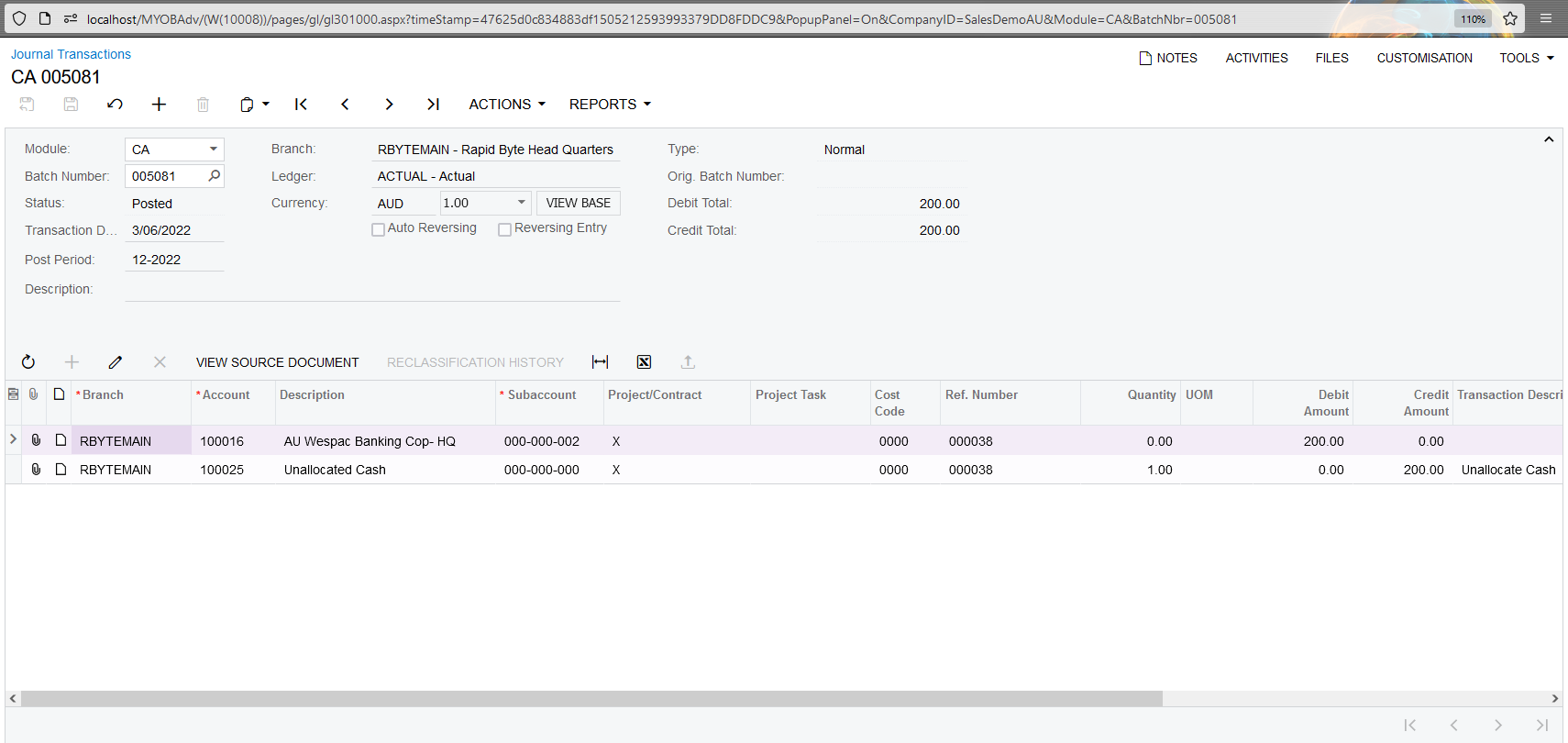

This is the result of the posting – the system debits the cash GL account and credits the unallocated cash GL account:

- Once you’ve identified who the customer is for your payment, go to the Reclassify Payments screen (CA506500), select the unallocated cash entry type, which will show you the transactions you need to reclassify. Select the transactions and click Process.

- After the reclassification is done, the system generates a payment from an unallocated cash account for the customer.

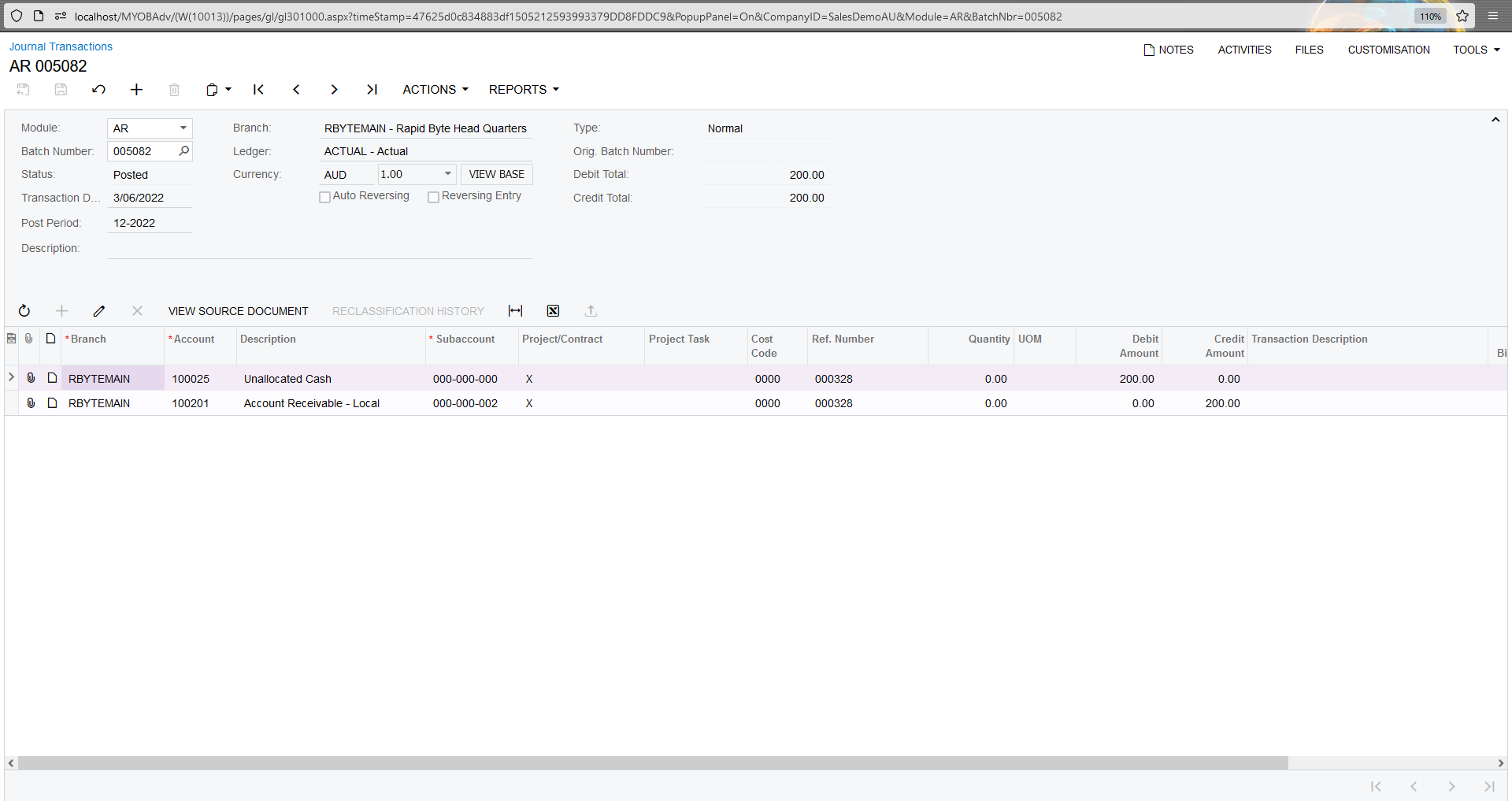

The resultant The posted payment shows the debit of unallocated Ccash and credit of AR.

The resultant The posted payment shows the debit of unallocated Ccash and credit of AR.