Reconciling the purchase accrual account

This is about detecting discrepancies in and reconciling the purchase accrual account.

Build 2021.117.400.6951 [21.117.0037] onward.

- To show a list of unbilled purchase receipts, you can use report Purchase Accrual Details - PO631000. This report will show you a list of PO that have been receipted but not yet billed.

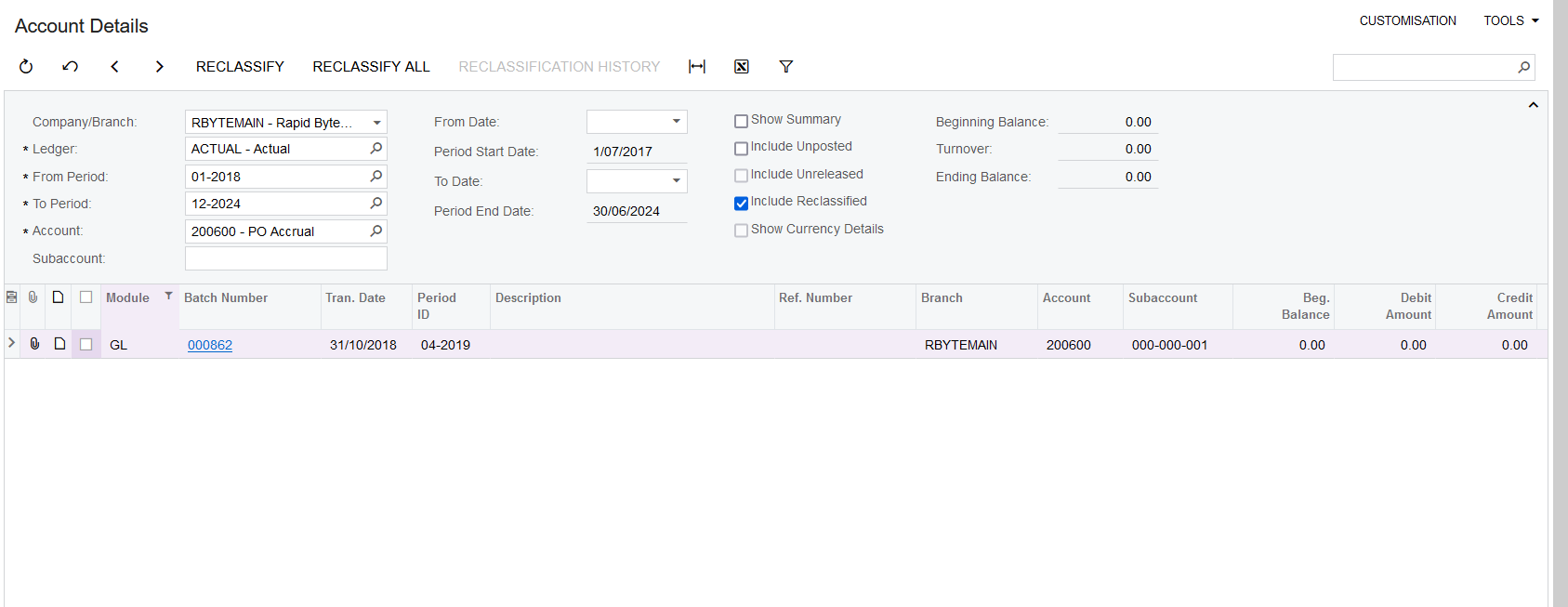

- There are a few possible causes of the discrepancies in the Purchase Accrual Account. Firstly, the discrepancies can happen when there’s a direct GL entry made to the Purchase Accrual Account. You can use the Account Details inquiry, filter the PO Accrual Account, and filter Module = “GL” to detect transactions that come from the GL module. You can then post a reversing entry appropriately to reverse the amount that causes the imbalance in the PO Accrual Account.

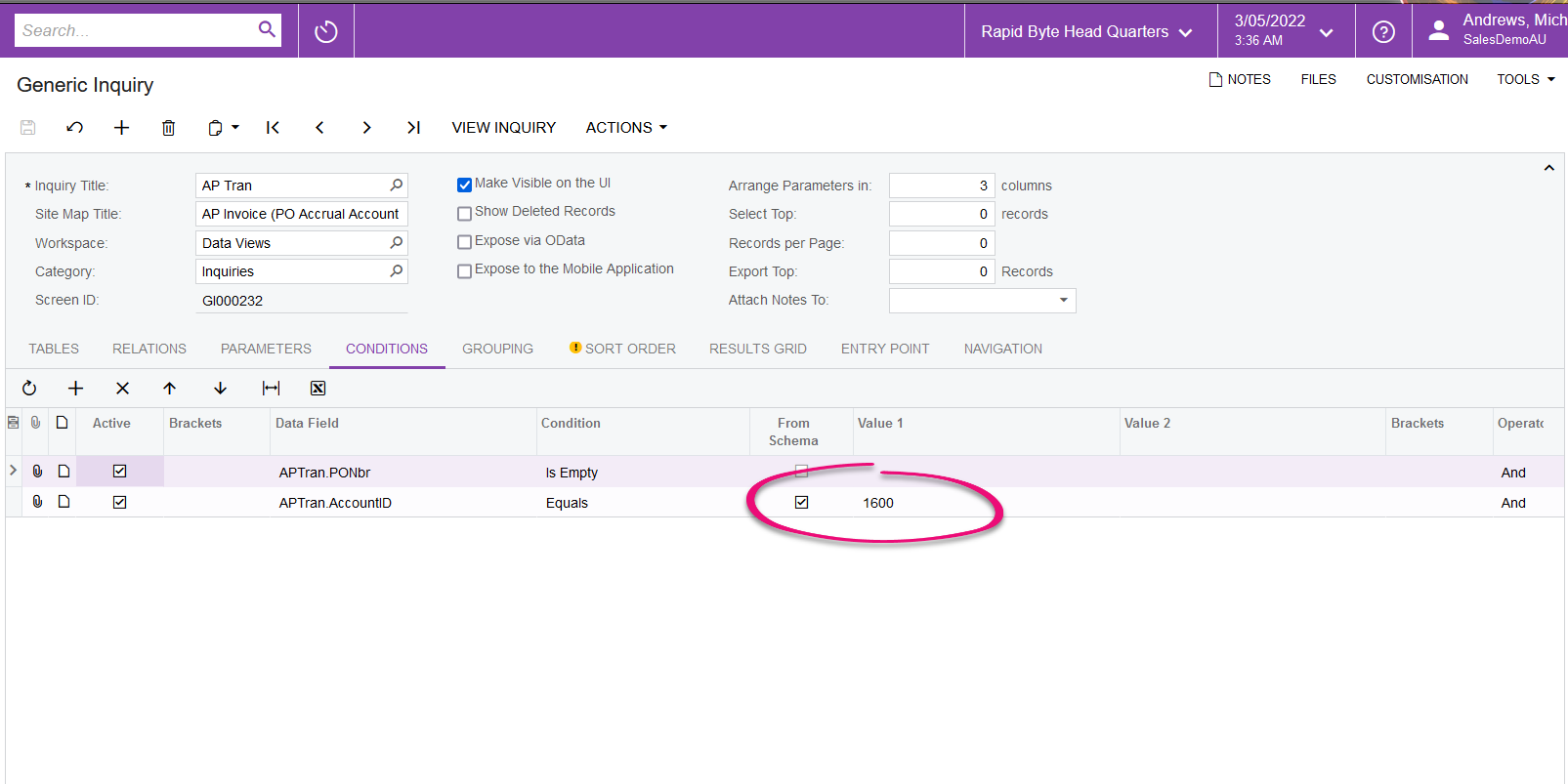

- Imbalance can occur if the AP invoice or AP credit note (Debit Adjustment) has been coded directly to the PO Accrual account and has not been properly converted from PO Receipt or PO Return. You can use the attached GI AP Tran.XML to find AP Transactions lines that posts directly to the PO Accrual Account instead of Expenses account to determine the imbalance. Remember to set the condition to the PO Accrual Account: AP Tran.xml

- Imbalance can occur if the Inventory Receipt or Issue transaction has been entered in the system directly coding to a PO accrual account but is not linked to a PO receipt to the AP Invoice process. You can use the attached GI IN Tran.XML to find Inventory Transactions lines that posts directly to the PO Accrual Account which could result in imbalance. Remember to set the condition to the PO Accrual Account: IN Tran.xml