Simple field service configurations with projects

This page is for MYOB Acumatica consultants

Check all changes in a test environment before taking them live. Make sure all related features still work as expected and that your data is unaffected.

If your customer want to use the field service module and also wants to capture the costs and revenues from service orders or appointments to the project, this knowledge base article will give you an overview of how the integration works. You can extend the functionality or add additional features if required, but this will give you the most simple set up to make Field Service and Project Accounting work together.

Build 2021.117.400.6951 [21.117.0037] onward.

To configure a simple Field Service and Project Accounting integration and demonstrate the workflow:

- Create a Service Order Type that will be used for Project. Ensure the followings are configured:

- Generated Billing Documents = Project Transaction.

- Account Group = select a REVENUE/INCOME type account group.

- Reason code: Select a reason code that is used for GL Entries in consumption of Inventory.

- Create a simple project – we’ll use a T&M type project as an example:

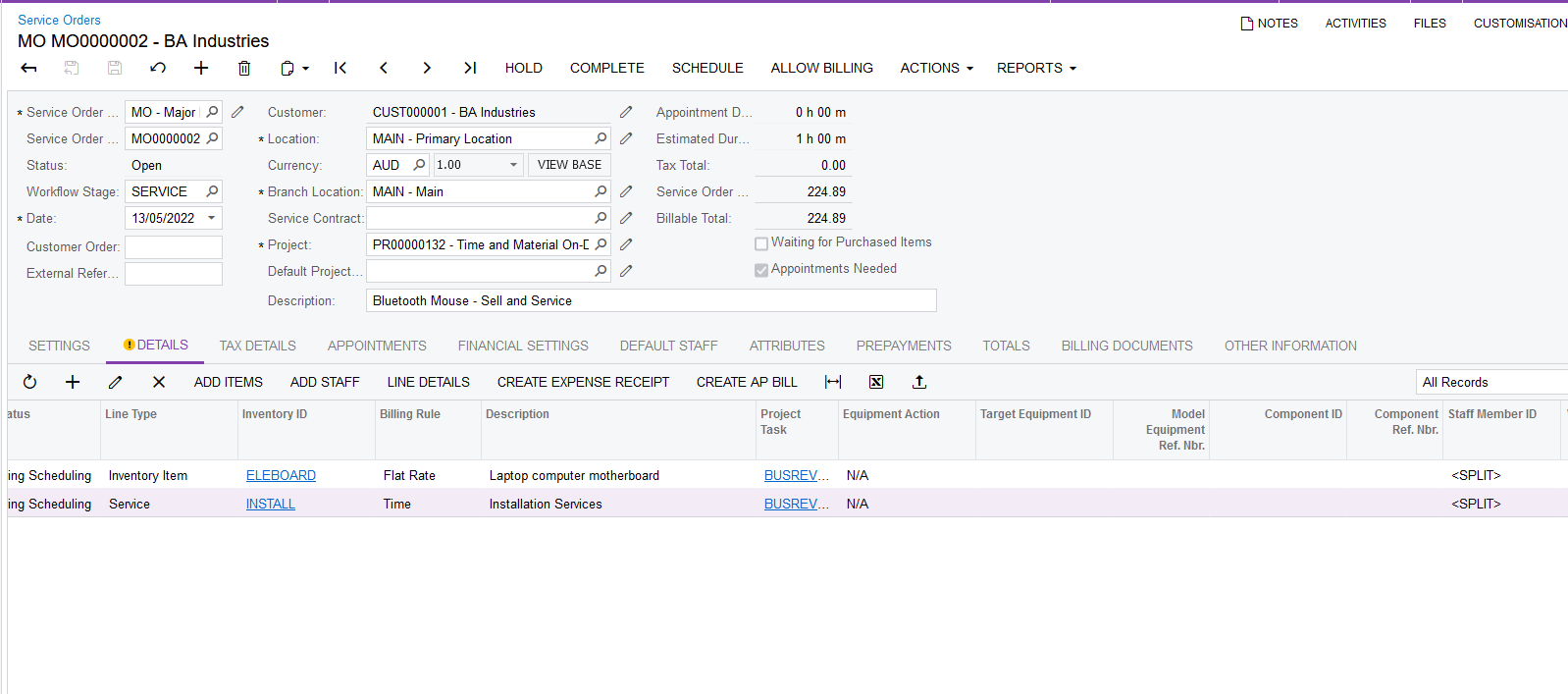

- Create a Service Order using the order type we created in step 1. Assign the Project and Project task from the project created in step 2 to this Service Order. Also, add one Inventory Item and Service Item to the Service Order.

- Finish the appointment, run service order billing. The service order billing will generate project transactions for this service order – these are revenue transactions and are posted to the REVENUE account group:

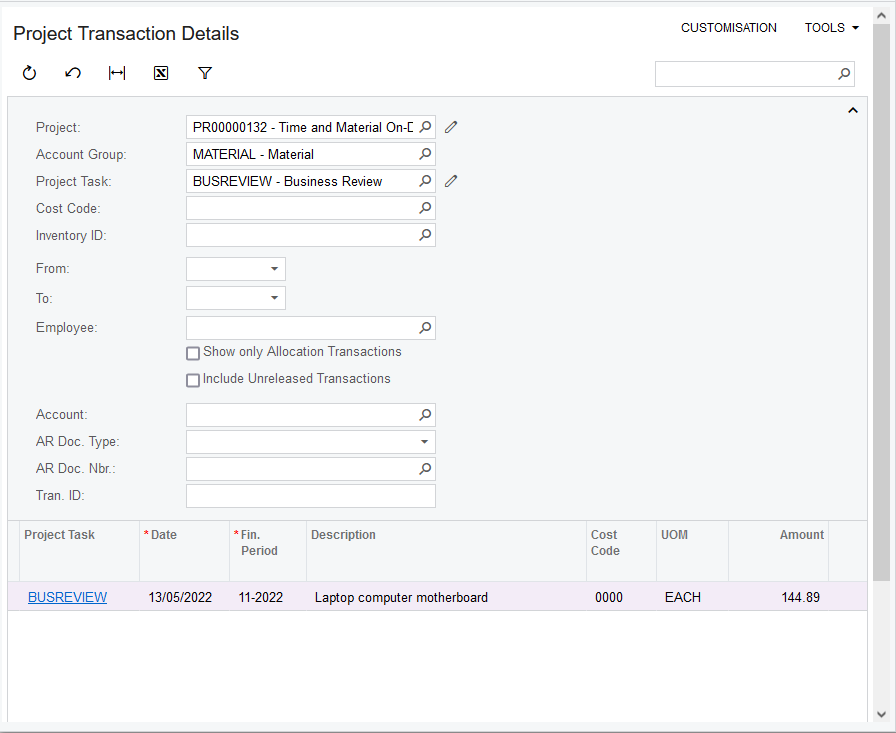

- If you check the Cost Budget, you can also see that the COGS is also posted to the MATERIAL account group, and similarly, if there’s timesheet entries, it’ll go to the LABOUR account group.