View tax accumulated by period and related documents

This page is for MYOB Acumatica consultants

Check all changes in a test environment before taking them live. Make sure all related features still work as expected and that your data is unaffected.

It’s a common scenario that a business might report quarterly tax, but needs access to period-to-date tax information for analysis. This knowledge base article explains how to get the period to date tax information, including the related documents containing the tax.

These instructions are for MYOB Acumatica builds 2021.117.400.6951 [21.117.0037] onward.

-

To get the most up to date tax information, firstly, go to the Prepare Tax Report screen (TX501000), and prepare tax report for the period you would like to view.

-

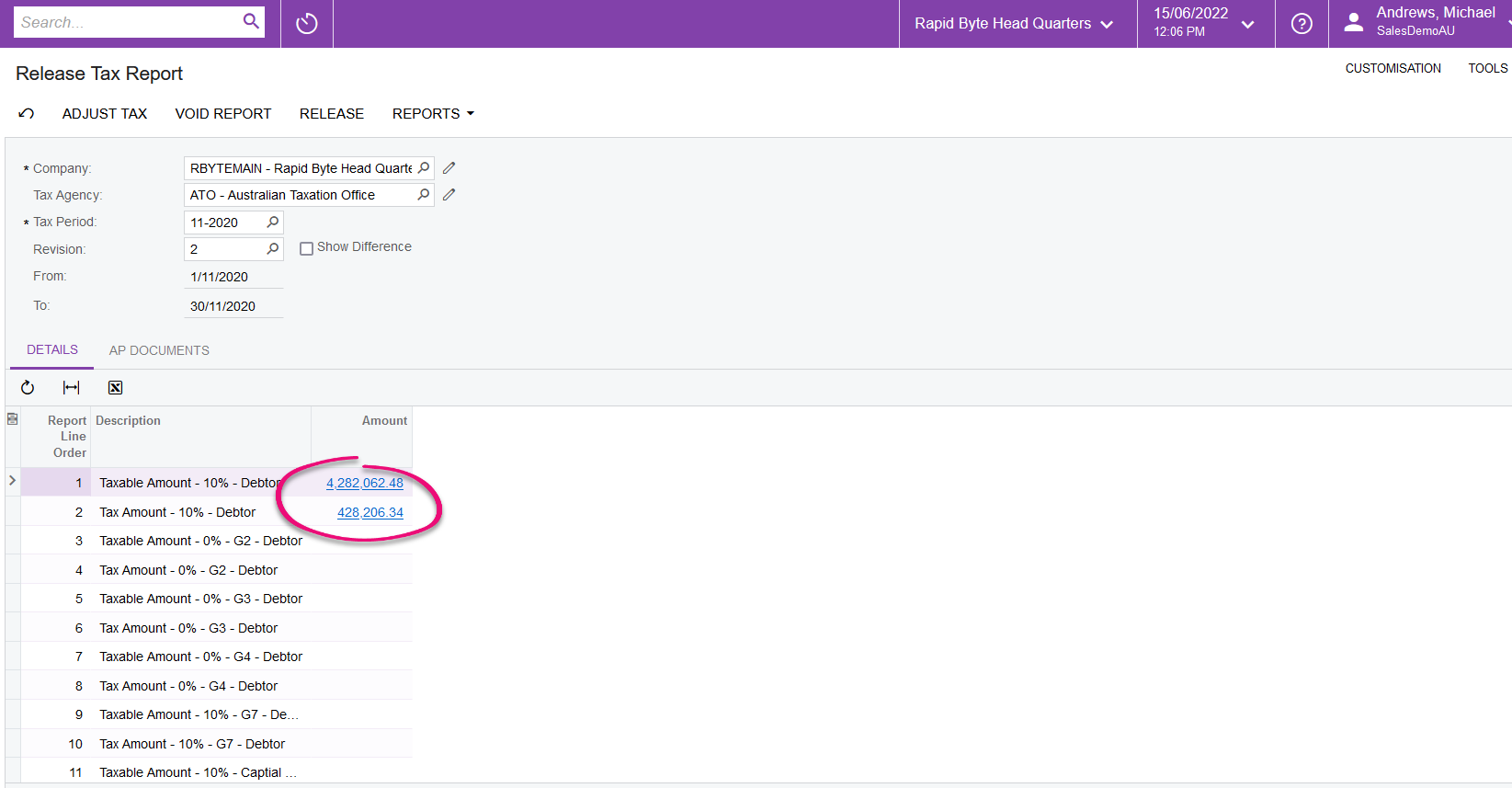

Go to the Release Tax Report screen (TX502000) – do not release the tax report – for each type of tax, you can click on the amount to drill down:

-

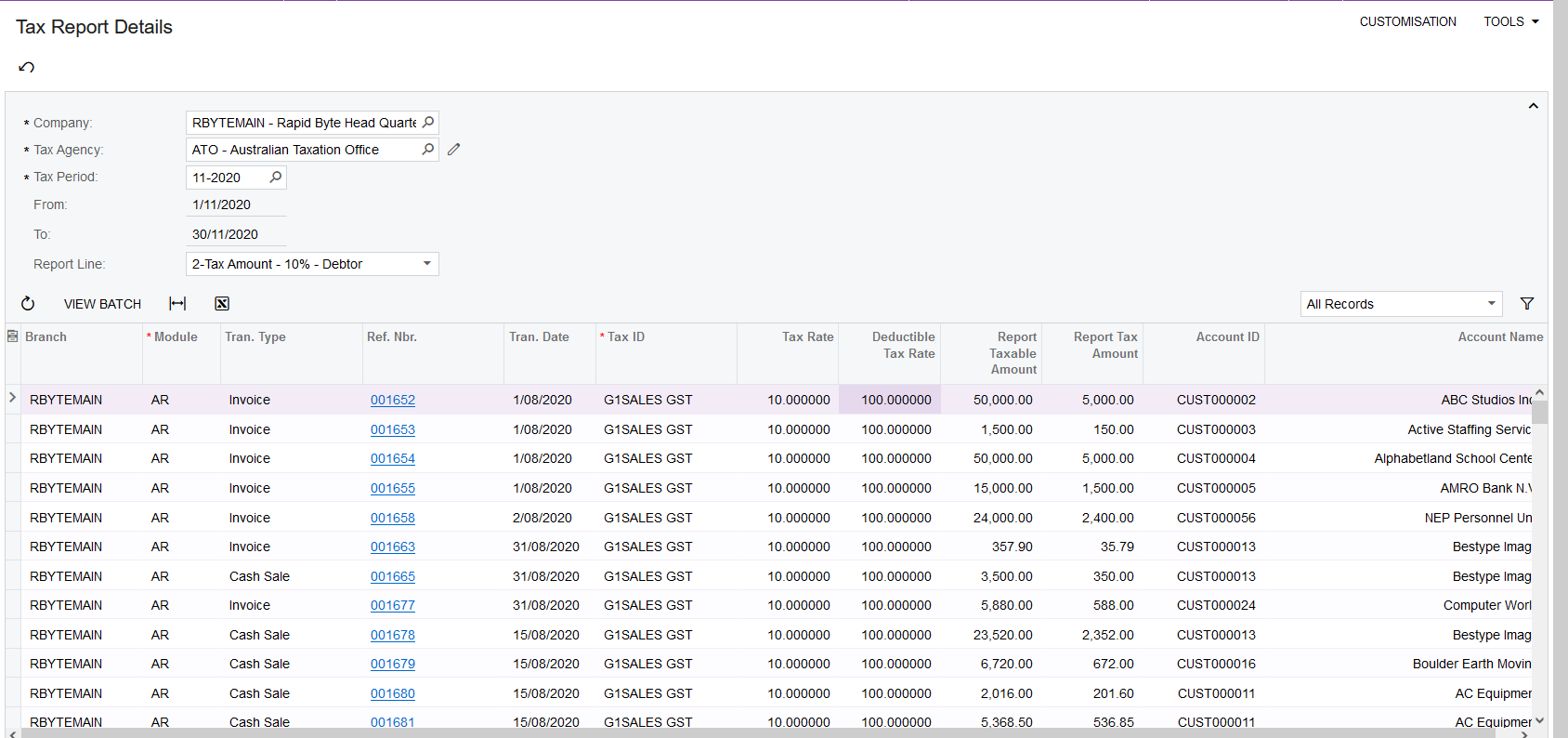

The drill down will show you how the amount is made up, and the related documents for that tax:

-

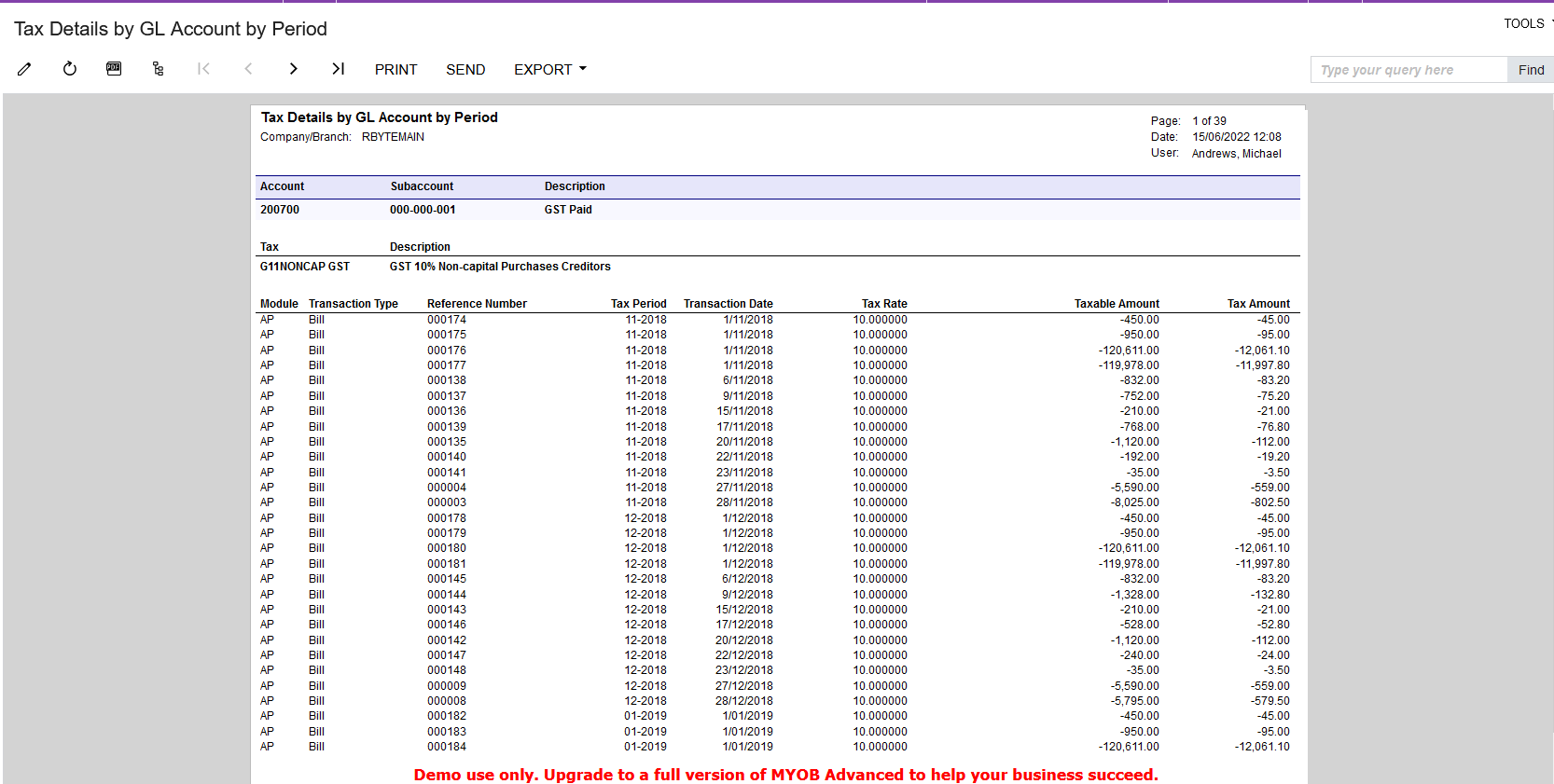

If you need to print the report, you can run the Tax Detail by GL Account by Period report (TX621500):

-

After you finish, go back to the Release Tax Report screen (TX502000) and void the report. You can prepare and void as many times as required. But once released, the amount is final. Any unreported transactions will be reported into the next period.